Market Overview 2025-2033

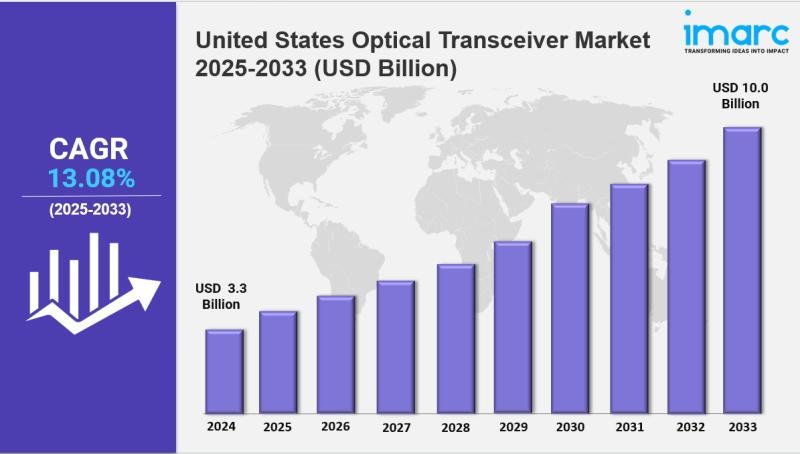

The United States optical transceiver market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.0 Billion by 2033, exhibiting a growth rate (CAGR) of 13.08% during 2025-2033. The market is expanding due to rising data traffic, 5G deployment, and demand for high-speed connectivity. Growth is driven by cloud computing, data center expansion, and advanced networking technologies, making the industry more innovative, efficient, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising data traffic and demand for high-speed internet

✔️ Expanding deployment of 5G networks and data centers across the country

✔️ Advancements in optical communication technologies enhancing transmission speed and energy efficiency

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-optical-transceiver-market/requestsample

United States Optical Transceiver Market Trends and Drivers:

The United States optical transceiver market is undergoing major changes, driven by the growing need for faster and more reliable data transmission. As cloud services, connected devices, and high-definition streaming continue to expand, there’s a rising demand for high-performance optical transceivers across the country’s telecom and data center infrastructure. The rollout of 5G and the growing presence of edge computing have pushed telecom providers and hyperscale operators to invest in faster fiber networks and high-speed backhaul systems, directly boosting the United States optical transceiver market size.

Major cloud players like AWS, Google, and Microsoft are leading this demand, requiring 400G and 800G transceivers to support massive data traffic. On the manufacturing side, companies like Intel and Coherent are increasing domestic production as part of a larger strategy to reduce dependence on foreign supply chains. Federal support, particularly through the CHIPS Act and trade policy adjustments, has played a significant role in reinforcing the country’s leadership in this space and increasing the United States optical transceiver market share There’s also a growing focus on security.

As government and enterprise networks tighten cybersecurity measures, demand is rising for optical transceivers that include encryption technologies like MACsec and IPsec to protect data as it travels at high speeds. Coherent transceivers remain essential for long-distance and metro area networks due to their efficiency and advanced signal handling, while demand is increasing for compact and durable modules like QSFP-DD and OSFP for edge and data center use. Rural broadband initiatives under the 2024 Infrastructure Bill are expanding the market further. These programs are driving purchases of 25G and 50G transceivers in underserved communities, helping expand the United States optical transceiver market size beyond traditional urban data hubs.

At the same time, advances in silicon photonics are cutting manufacturing costs, improving performance, and helping providers meet energy efficiency standards set by the Department of Energy. Looking toward 2025, new technologies such as generative AI and machine learning are creating demand for even faster data center connectivity, accelerating interest in 1.6T transceivers and next-generation network designs. These shifts are beginning to reshape the United States optical transceiver market share, as leading vendors compete to provide scalable solutions that meet future data workloads.

Emerging research in quantum networking and cryogenic transceivers is also opening new doors for specialized use cases in national defense and scientific research. With sustainability, security, and performance now top priorities, the United States optical transceiver market is entering a new phase. Open ROADM standards are reducing deployment costs and supporting more flexible network architectures. Meanwhile, technologies like co-packaged optics and quantum key distribution (QKD) are pointing the way forward for optical communications. These developments reflect strong momentum in the market, backed by innovation, policy support, and demand from a wide range of sectors-from telecom to government.

Buy Report Now: https://www.imarcgroup.com/checkout?id=20184&method=1190

United States Optical Transceiver Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Form Factor:

• SFF and SFP

• SFP+ and SFP28

• QSFP, QSFP+, QSFP14 and QSFP28

• CFP, CFP2, and CFP4

• XFP

• CXP

• Others

Breakup by Fiber Type:

• Single Mode Fiber

• Multimode Fiber

Breakup by Data Rate:

• Less Than 10 Gbps

• 10 Gbps To 40 Gbps

• 40 Gbps To 100 Gbps

• More Than 100 Gbps

Breakup by Connector Type:

• LC Connector

• SC Connector

• MPO Connector

• RJ-45

Breakup by Application:

• Data Center

• Telecommunication

• Enterprises

Breakup by Region:

• Northeast

• Midwest

• South

• West

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=20184&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.