The latest report by IMARC Group, “Philippines Digital Wallet Market Report by Type (Proximity, Remote), Deployment Type (On-premises, Cloud), Industry Vertical (Education, Gaming, Information Technology and Telecommunications, Aerospace and Defense, Legal, Media and Entertainment, Automotive, Banking Financial Services and Insurance, Consumer Goods, and Others), and Region 2025-2033,” provides an in-depth analysis of the Philippines digital wallet market.

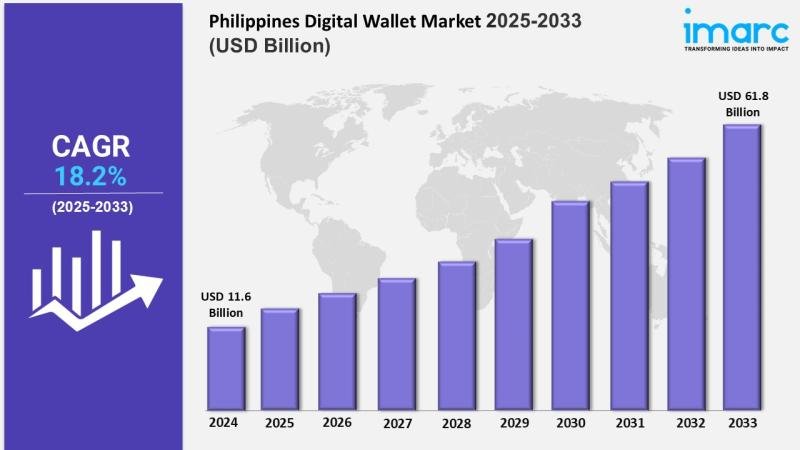

The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines digital wallet market size reached USD 11.6 Billion in 2024 and is projected to grow to USD 61.8 Billion by 2033, exhibiting a CAGR of 18.2% during the forecast period.

Report Attributes and Key Statistics:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 11.6 Billion

• Market Forecast in 2033: USD 61.8 Billion

• Market Growth Rate (2025-2033): 18.2% CAGR

Philippines Digital Wallet Market Overview:

The Philippines digital wallet market is encountering fast development, with buyers and businesses dynamically utilizing smartphones and moved forward web organize to urge to money related organizations. Companies are rolling out user-friendly wallet apps, supporting day by day buys, cash trades, and charge installments. Government courses of action are progressing computerized thought, while collaborations between banks, telecoms, and fintechs are broadening showcase reach. The prospering e-commerce section is enlivening computerized wallet apportionment, promoting secure and reliable installment experiences. As computerized wallets have gotten to be more open, they are engaging financial participation undoubtedly in blocked-off and underserved locales, reshaping the country’s installment scene.

Request For Sample Report: https://www.imarcgroup.com/philippines-digital-wallet-market/requestsample

Philippines Digital Wallet Market Trends and Drivers:

The market is witnessing a surge in progressed wallet integration with e-commerce stages, allowing for fast and secure checkouts. Organizations among banks, telcos, and fintechs are driving headway, though spurring strengths such as cashback rewards and dedication centers are boosting client engagement. Updated security highlights, checking encryption, and two-factor authentication are extending customer acceptance. The rise of QR code installments and contactless trades is reshaping retail experiences. As flexible and broadband participations create, computerized wallets are coming to a more broad measurement, supporting both small-value trades and greater retail buys.

Imaginative movements in flexible contraptions and web foundations are making progressive wallets more open and tried and true. The government’s push for money-related thought and progressive alter is an engaging assignment, especially among the unbanked people. The booming e-commerce industry and extending smartphone entrance are fueling the ask for supportive and secure installment courses of action. Lower trade costs, cost-effective organizations, and integration with rewards programs are pulling in more clients. The grandstand, in addition, is driven by collaborative endeavors among banks, telecoms, and fintechs to expand progressed wallet offerings and reach.

Philippines Digital Wallet Key Growth Drivers:

• Rising smartphone and internet penetration

• Thriving e-commerce industry

• Government initiatives for digital inclusion

• Collaboration among banks, telecoms, and fintechs

• Cost-effective and secure transaction solutions

• Incentives such as cashback and rewards

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/philippines-digital-wallet-market

Philippines Digital Wallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, deployment type, and industry vertical.

By Type:

• Proximity

• Remote

By Deployment Type:

• On-premises

• Cloud

By Industry Vertical:

• Education

• Gaming

• Information Technology and Telecommunications

• Aerospace and Defense

• Legal

• Media and Entertainment

• Automotive

• Banking, Financial Services and Insurance

• Consumer Goods

• Others

By Region:

• Luzon

• Visayas

• Mindanao

Competitive Landscape:

The report provides a comprehensive analysis of the competitive landscape, including market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant. Detailed profiles of all major companies operating in the Philippines digital wallet market are included.

Philippines Digital Wallet Market News:

• In February 2025, Rakuten Viber announced the launch of Viber Pay in the Philippines, enabling peer-to-peer and business payments within its messaging app.

• In 2025, the number of mobile subscribers in the Philippines is anticipated to reach 159 million, further expanding digital wallet accessibility.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=23574&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 631 791 1145 | Asia: +91 120 433 0800 | UK: +44 753 714 6104

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.