Market Overview 2025-2033

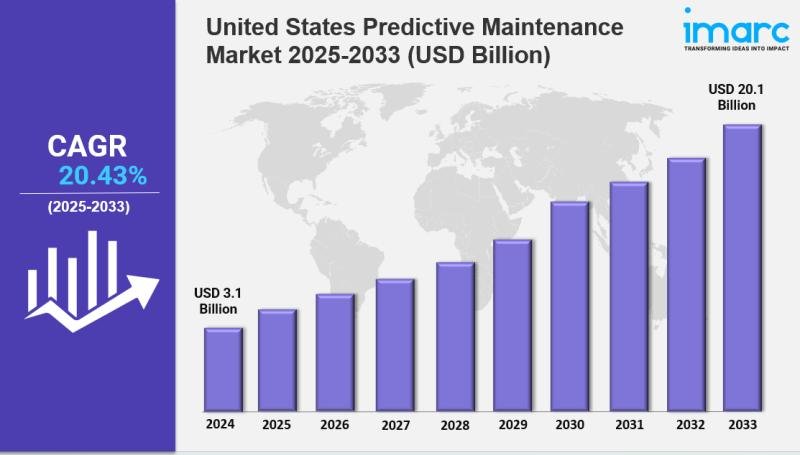

United States predictive maintenance market size reached USD 3.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.1 Billion by 2033, exhibiting a growth rate (CAGR) of 20.43% during 2025-2033. The market is growing due to rising industrial data analytics demand, rapid 5G deployment, and automation initiatives. Growth is driven by AI‐enhanced IoT sensors, digital twin technologies, and cloud platforms, making the sector more predictive, cost‐effective, and competitive

Key Market Highlights:

✔️ Strong market growth driven by increasing adoption of IoT and AI for equipment monitoring and failure prevention

✔️ Rising demand across manufacturing, energy, and transportation sectors for cost-effective asset management

✔️ Expanding use of cloud-based platforms and real-time analytics to enhance operational efficiency and reduce downtime

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-predictive-maintenance-market/requestsample

United States Predictive Maintenance Market Trends and Drivers:

The United States Predictive Maintenance Market is expanding rapidly as more industries turn to advanced technologies to keep aging infrastructure running smoothly and reduce costly downtime. In 2024 alone, sensor deployments rose by 37%, helping manufacturers monitor the health of critical equipment in real-time. Using machine learning, companies now analyze vibration, temperature, and sound data to predict when a machine might fail-often 7 to 14 days in advance This proactive approach has already cut unplanned downtime by as much as 45%. Major sectors like aerospace and automotive are leading the charge. For example, Boeing saved $18 million annually in turbine maintenance thanks to predictive analytics. In remote locations like oil fields, edge computing has become essential, allowing data to be processed on-site for immediate insights.

However, not all companies have made a smooth transition. About 68% of small and mid-sized enterprises (SMEs) report issues integrating modern predictive maintenance tools with their older SCADA systems. That’s fueling demand for hybrid cloud-edge solutions that don’t require full system overhauls-keeping costs manageable while still modernizing operations. A key trend shaping the United States Predictive Maintenance Market Share is the rise of “Maintenance-as-a-Service” models. Instead of selling equipment outright, OEMs like Siemens and GE now offer contracts based on uptime performance. These agreements often guarantee over 95% availability, with embedded sensors and digital twins tracking equipment from day one. The wind energy sector has especially benefited-operators report annual savings of $120 per kilowatt thanks to better blade maintenance planning.

But as AI-only startups enter the market offering retrofit solutions for legacy equipment, traditional providers are feeling pressure to develop their own in-house predictive algorithms or risk losing ground. Cybersecurity has also become a critical concern. As more devices connect through IIoT networks, vulnerabilities grow. In 2024, ransomware attacks on manufacturers surged 214%, with hackers even triggering fake failure alerts through compromised sensors. In response, companies are embedding zero-trust security directly into their monitoring systems. Encryption is now standard for data from pressure and vibration sensors, and some firms are even using blockchain to create secure audit trails.

While this adds 15-22% to overall solution costs, it has lowered breach risks by nearly 80%. As a result, insurers now offer discounts for certified systems, and agencies like the FDA have begun mandating encrypted predictive tech for medical device makers. These security features now account for nearly 30% of the United States Predictive Maintenance Market Share, raising the entry bar for providers without compliant solutions. The market is being transformed by both technological progress and financial necessity. Deep learning systems can now merge data from different types of sensors-thermal, acoustic, electrical-and accurately predict failures with over 92% reliability, outperforming older maintenance strategies. This innovation gained momentum in 2024 as manufacturers, grappling with semiconductor shortages, pushed older machines to their limits. Many saw a threefold return on investment in predictive maintenance within just eight months.

Still, implementation isn’t always easy. About 60% of companies report data silos when trying to connect legacy PLCs with modern AI systems. Middleware software is often needed, and it can eat up 30-40% of a project’s budget. Another challenge is talent. There’s a growing need for professionals who understand both operations and IT systems, but demand currently outpaces supply by a factor of four. To close the gap, vendors are rolling out no-code platforms that allow frontline workers to run diagnostics without needing a data science degree On the regulatory side, new safety standards from OSHA and defense-specific requirements like DoD’s MIL-STD-3031 are pushing more sectors-especially aerospace and defense-toward predictive solutions.

Looking ahead, emerging tech like quantum computing could open the door to highly accurate modeling of material fatigue at the atomic level. Meanwhile, generative AI is being used to simulate rare machine failures, training systems to handle events too unusual to capture in real life. With all of these shifts underway, the United States Predictive Maintenance Market is positioned for long-term growth, blending cutting-edge tech with evolving operational needs. As predictive systems prove their value across more industries, their share of the broader maintenance landscape will only continue to grow.

Buy Report Now: https://www.imarcgroup.com/checkout?id=20408&method=1190

United States Predictive Maintenance Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Component:

• Solution

• Service

Breakup by Technique:

• Vibration Monitoring

• Electrical Testing

• Oil Analysis

• Ultrasonic Leak Detectors

• Shock Pulse

• Infrared

• Others

Breakup by Deployment Type:

• On-premises

• Cloud-based

Breakup by Organization Size:

• Large Enterprises

• Small and Medium-sized Enterprises

Breakup by Industry Vertical:

• Manufacturing

• Energy and Utilities

• Aerospace and Defense

• Transportation and Logistics

• Government

• Healthcare

• Others

Breakup by Region:

• Northeast

• Midwest

• South

• Wes

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=20408&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.