Market Overview 2025-2033

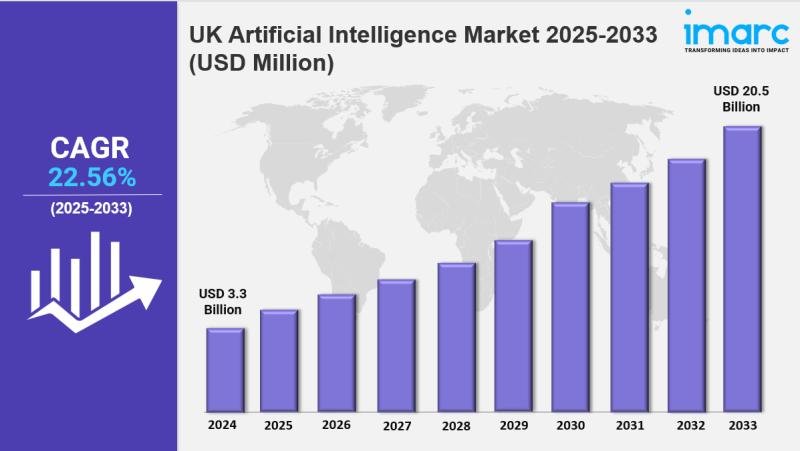

The UK artificial intelligence market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.5 Billion by 2033, exhibiting a growth rate (CAGR) of 22.56% during 2025-2033. The market is growing due to increasing demand for AI-driven solutions, robust government support, and a thriving tech ecosystem. Growth is driven by substantial investments, a skilled talent pool, and strategic partnerships, making the industry more dynamic, innovative, and globally competitive.

Key Market Highlights:

✔️ Strong market growth driven by government investment and digital transformation across industries

✔️ Increasing adoption of AI in healthcare, finance, and retail for automation and efficiency

✔️ Expanding research initiatives and startup ecosystem fueling innovation in AI technologies

Request for a sample copy of the report: https://www.imarcgroup.com/uk-artificial-intelligence-market/requestsample

UK Artificial Intelligence Market Trends and Drivers:

The UK artificial intelligence market is growing fast. This growth comes from the country’s flexible and innovation-friendly regulations. Unlike the EU’s strict AI Act, the UK’s framework helps sectors like finance use advanced AI systems quickly. Major banks like HSBC and Barclays have launched real-time fraud detection tools. These tools are 40% more accurate than older models. This regulatory flexibility has caused a 78% increase in RegTech AI investment year-on-year as of Q3 2024. There’s a strong emphasis on algorithmic compliance monitoring. In late 2024, the AI Safety Institute was created to support this growth. It provides sandbox environments for testing high-risk AI applications.

This helps cut deployment times by up to six months. However, harmonizing regulations across sectors is still a challenge. While fintech enjoys quick approvals, healthcare AI tools face tougher MHRA validations. This creates cost differences. The balancing act between innovation and risk management is influencing corporate strategies. Now, 63% of FTSE 350 firms have dedicated AI governance teams. This shows how important compliance is in the UK artificial intelligence market. In the industrial realm, decentralized AI is revolutionizing UK manufacturing. Companies like Rolls-Royce now process turbine sensor data on-site with NVIDIA Jetson modules. This cuts reliance on cloud infrastructure by 90% and enables predictive maintenance in just 0.2 seconds.

This change led to £2.1 billion in private investment for 5G-powered smart factories in 2024. Facilities in the Midlands saw a 17% increase in throughput after adding AI-driven quality control systems. The National Edge Computing Testbed in Manchester has sparked innovation, creating 84 partnerships between academia and industry. These groups aim to develop custom chipsets for edge AI. But energy use is still a concern. Edge nodes use three times more power than centralized systems. This has pushed hardware firms like Graphcore to look into neuromorphic processing architectures. As the UK Artificial Intelligence Market approaches an £8.7 billion valuation by 2026, edge infrastructure will be crucial for competition.

Talent shortages represent another critical pressure point. The demand for multimodal AI specialists now outpaces supply by 5:1, causing salary inflation and reshaping hiring strategies. In London, NLP engineers are commanding base salaries of £145,000-35% above the EU average. Prompt engineering has also emerged as a key driver in media and content verticals. The 2024 AI Scholarship Programme funded 2,000 industry placements. However, it only covered 12% of the talent gap. Cross-industry poaching is widespread. For example, Amazon hired 40% of its UK AI team from the BBC and Reuters. Even with a 300% increase in AI conversion program enrollments, employers find graduates lack deployment-ready skills. This gap has led to more talent-driven acquisitions.

Firms like Faculty AI and BenevolentAI are now valued more for their teams than their intellectual property. This trend is common in the UK Artificial Intelligence Market. Despite economic uncertainties, the UK Artificial Intelligence Market shows strong growth. AI now supports 28% of NHS diagnostic imaging and powers 45% of London Stock Exchange transactions. Both figures have doubled since early 2024. This growth comes from falling implementation costs. Cloud-based computer vision APIs are now 60% cheaper than in 2023. Open-source LLMs like Mistral have reduced NLP development costs by 75%. London and Cambridge are still key centers for innovation. They attracted 81% of the £3.4 billion in VC funding for AI in 2024. New hotspots are also emerging. Scotland’s AI Triangle, which includes Edinburgh, Glasgow, and Stirling, attracted £410 million in robotics investment.

Initiatives like the Manchester Prize have crowdsourced over 120 civic AI applications. However, regulatory uncertainty remains. Delays in the Data Protection Bill raise questions about the legality of sourcing datasets for model training. On the technology front, retrieval-augmented generation (RAG) architectures dominate enterprise AI deployments. Companies like Aviva use RAG to personalize customer interactions without retraining entire models Meanwhile, the UK is doubling down on sovereign AI strategies. The government’s Exascale computing plan targets cutting foreign foundation models to below 50% by 2027. This step is vital for digital sovereignty. With rising ethical concerns, the UK’s balanced regulatory approach helps the **UK Artificial Intelligence Market** lead in responsible AI development. This also supports long-term economic growth.

Checkout Now: https://www.imarcgroup.com/checkout?id=24917&method=1060

UK Artificial Intelligence Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Solution:

• Hardware

o Accelerators

o Processors

o Memory

o Network

• Software

• Services

o Professional

o Managed

Breakup by Technology:

• Deep Learning

• Machine Learning

• Natural Language Processing (NLP)

• Machine Vision

• Generative AI

Breakup by Function:

• Cybersecurity

• Finance and Accounting

• Human Resource Management

• Legal and Compliance

• Operations

• Sales and Marketing

• Supply Chain Management

Breakup by End-Use:

• Healthcare

o Robot Assisted Surgery

o Virtual Nursing Assistants

o Hospital Workflow Management

o Dosage Error Reduction

o Clinical Trial Participant Identifier

o Preliminary Diagnosis

o Automated Image Diagnosis

• BFSI

o Risk Assessment

o Financial Analysis/Research

o Investment/Portfolio Management

o Others

• Law

• Retail

• Advertising and Media

• Automotive and Transportation

• Agriculture

• Manufacturing

• Others

Breakup by Region:

• London

• South East

• North West

• East of England

• South West

• Scotland

• West Midlands

• Yorkshire and The Humber

• East Midlands

• Others

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=24917&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.