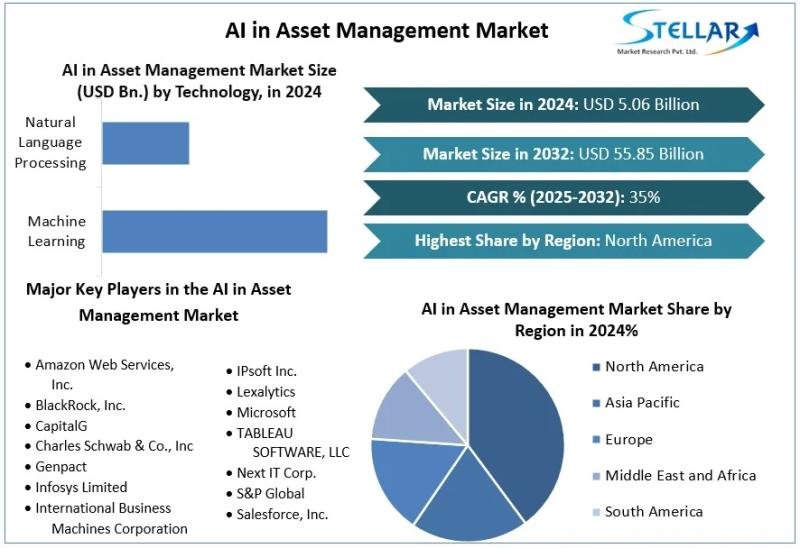

AI in Asset Management Market Overview

The global AI in Asset Management market is poised for significant growth, with projections indicating an expansion from USD 5.06 billion in 2024 to USD 55.85 billion by 2032, reflecting a robust CAGR of 35% during the forecast period.

AI in Asset Management Market Estimation, Growth Drivers & Opportunities

The AI in Asset Management sector is experiencing rapid transformation, driven by the increasing adoption of cloud computing, which offers scalability, flexibility, and cost efficiency for handling vast datasets. Asset managers are launching AI-driven investment products to attract investors seeking exposure to AI-enhanced strategies. The integration of AI technologies enables more informed decision-making, risk assessment, and portfolio optimization, thereby enhancing overall asset management efficiency.

Free sample report ppt: https://www.stellarmr.com/report/req_sample/AI-in-Asset-Management-Market/1516

U.S. Market Trends and Investments

In the United States, the asset management industry is witnessing a surge in AI adoption. Goldman Sachs, for instance, has significantly integrated AI into its operations through tools developed via its AI platform launched in mid-2024. These tools, including the GS AI Assistant, are now accessible to 10,000 of the firm’s 46,000 employees, with plans to extend availability firm-wide by year-end. The AI system is built atop platforms like Google’s Gemini and OpenAI’s ChatGPT, enhanced with layers to protect sensitive information. Employees across various levels have praised the technology for improving efficiency and innovation.

Additionally, asset managers are expanding their offerings of exchange-traded funds (ETFs) focused on AI to attract investors enthusiastic about the sector. Data from Morningstar reveals that over one-third of the 24 AI-themed ETFs were launched in 2024, boosting AI ETFs’ assets to $4.5 billion. Companies like BlackRock have introduced actively managed AI ETFs to capture emerging opportunities.

AI in Asset Management Market Segmentation: Dominance of Machine Learning

Within the AI in Asset Management market, machine learning stands out as the dominant technology segment. In 2019, machine learning accounted for approximately 65% of the market’s revenue share. This dominance is attributed to its widespread adoption in enabling portfolio management decisions and enhancing risk assessment capabilities.

By Technology

Machine Learning

Natural Language Processing

By Application

Portfolio Optimization

Conversational Platforms

Risk & Compliance

Data Analysis

Process Automation

Others

Access the full report: https://www.stellarmr.com/report/AI-in-Asset-Management-Market/1516

Competitive Analysis: Leading Companies and Innovations

The global AI in Asset Management market is characterized by the presence of several key players driving innovation and market growth:

BlackRock Inc.: As a pioneer in integrating AI into asset management, BlackRock continues to enhance its Aladdin platform, focusing on predictive analytics and risk management tools. The company has also launched actively managed AI ETFs to capitalize on emerging opportunities in the AI sector.

JPMorgan Chase & Co.: JPMorgan has invested heavily in AI technologies to streamline operations and improve client services. The firm utilizes AI for various applications, including fraud detection, customer service chatbots, and investment analysis.

Morgan Stanley: Morgan Stanley employs AI to enhance its wealth management services, offering personalized investment strategies and insights to clients. The firm’s AI initiatives focus on natural language processing and machine learning to analyze market trends and client data.

Goldman Sachs Group, Inc.: Goldman Sachs has developed an AI platform that includes tools like the GS AI Assistant, built on platforms such as Google’s Gemini and OpenAI’s ChatGPT. These tools assist employees in tasks ranging from drafting and brainstorming to code assistance and problem-solving, enhancing overall productivity.

UBS Group AG: UBS leverages AI to optimize its asset management processes, focusing on improving investment strategies and client experiences. The firm invests in AI-driven research to stay ahead in the competitive financial services landscape.

Get (10-30%) Discount on Immediate Purchase: https://www.stellarmr.com/report/buy_now_report/AI-in-Asset-Management-Market/1516

Regional Analysis

United States: Leading the global market, the U.S. benefits from supportive government programs promoting AI adoption across various industries. The country’s robust technological infrastructure and significant investments by major financial institutions contribute to its dominant position.

United Kingdom: The UK is projected to lead the European AI in Asset Management market by 2030, driven by a strong financial sector and government initiatives supporting AI integration.

Germany: Germany is the fastest-growing regional market in Europe, expected to reach USD 667.0 million by 2030, with a CAGR of 25.7% from 2024 to 2030. The growth is fueled by advancements in machine learning and natural language processing technologies.

France: France’s AI in Asset Management market is anticipated to reach USD 790.1 million by 2030, growing at a CAGR of 24.7% from 2024 to 2030. The country’s focus on AI research and development supports this growth trajectory.

Japan: Japan’s market growth is supported by its technological advancements and government policies promoting AI integration in financial services.

China: China’s AI in Asset Management market is expanding due to substantial investments in AI technologies and supportive government policies encouraging innovation in the financial sector.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4 Kothrud

Pinnac Memories Fl. No. 3

Kothrud, Pune, Maharashtra, 411029

sales@stellarmr.com

+91 9607365656

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.