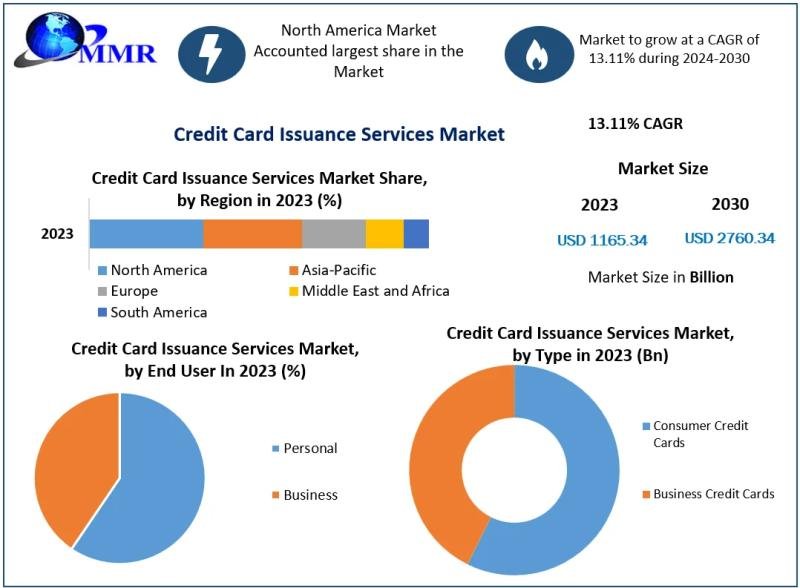

The Credit Card Issuance Services Market expected to hit USD 2760.34 Bn by 2030 from USD 1165.34 Bn in 2023 at a CAGR of 7.9 % during the forecast period

Credit Card Issuance Services Market Overview:

The credit card issuance landscape is undergoing a significant transformation, driven by the increasing demand for cashless transactions and the convenience of “buy now, pay later” options. Financial institutions are leveraging technology to offer seamless credit solutions, catering to the evolving needs of consumers who prioritize flexibility and security in their payment methods.

Emerging markets, particularly in Asia-Pacific, are witnessing a surge in credit card adoption. Countries like India, China, Japan, and South Korea present lucrative opportunities for issuers, as digital payment infrastructures expand and consumer awareness grows.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/186182/

Credit Card Issuance Services Market Dynamics:

The market’s growth is fueled by the widespread adoption of contactless payments, with studies indicating that nearly 80% of cardholders utilize this feature . Additionally, the rise of Buy Now, Pay Later (BNPL) services is reshaping consumer credit, offering alternatives that appeal to younger demographics and those with limited credit histories.

However, the market faces challenges, including the need for differentiation among issuers. Many companies focus on rational aspects like fees and rewards, potentially limiting their appeal. To sustain growth, issuers must innovate and offer unique value propositions that resonate with diverse consumer segments.

Credit Card Issuance Services Market Outlook and Future Trends

Looking ahead, the market is poised for continued expansion, driven by technological advancements and strategic partnerships. The integration of biometric authentication and real-time processing is enhancing security and user experience, setting new standards for credit card services.

Moreover, the convergence of financial services and technology is fostering innovation. Companies are developing API-driven platforms that allow for customizable credit solutions, enabling rapid deployment and tailored offerings that meet specific consumer needs.

Key Recent Developments:

Vietnam: In May 2023, Thailand’s Krungsri Bank acquired a 50% stake in SHBank Finance Company Limited, marking a significant move into Vietnam’s consumer finance sector. This strategic acquisition aims to capitalize on Vietnam’s growing demand for credit services.

Thailand: Krungsri Bank has solidified its position as Thailand’s leading credit card issuer, with over three million cards in circulation. The bank’s acquisition of GE Capital’s consumer finance businesses has been instrumental in expanding its customer base and service offerings.

Japan: Infcurion, a Japanese payments company, announced plans for a 2025 IPO to accelerate growth through mergers and acquisitions. Backed by Sumitomo Mitsui Financial Group, Infcurion aims to expand its digital wallet and credit card platforms across Asia.

South Korea: Sumitomo Mitsui Financial Group (SMFG) has expanded its credit card operations, surpassing 40 million cardholders. The group’s strategic acquisitions, including OMC Card, have strengthened its presence in the Asian market.

Singapore: United Overseas Bank (UOB) has committed $500 million to enhance its digital banking capabilities across ASEAN. The investment aims to double its digital customer base by 2026, with a focus on integrating services in countries like Malaysia and Vietnam.

United States: In August 2022, WebBank partnered with American Express to issue credit cards, expanding its fintech offerings. This collaboration allows WebBank to provide American Express benefits to a broader customer base.

Europe: Mastercard’s acquisition of Nets Group’s account-to-account services for approximately $3.12 billion has enhanced its capabilities in high-growth markets and e-commerce. This move aligns with Mastercard’s strategy to focus on issuer and merchant services

Credit Card Issuance Services Market Segmentation

by Type

1. Consumer Credit Cards

2. Business Credit Cards

by Issuers

1. Banks

2. Credit Unions

3. NBFCs

by End User

1.Personal

2. Business

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/186182/

Some of the current players in the Credit Card Issuance Services Market are:

1. Fiserv Inc.

2. Marqeta Inc.

3. Stripe Inc.

4. Giesecke+Devrient GmbH

5. Entrust Corporation.

6. GPUK LLP.

7. Nium Pte. Ltd.

8. Fis

9. Thales

10. American Express Company

11. SBI

12. IDFC Bank

13. HDFC Bank

14. Standard Chartered

15. CITI Bank

16. VISA

17. CHASE

18. Capital One

19. Discover Bank

20. Wells Fargo

For additional reports on related topics, visit our website:

♦ Virtual Fitting Room Market https://www.maximizemarketresearch.com/market-report/global-virtual-fitting-room-market/29023/

♦ China Smartphone Market https://www.maximizemarketresearch.com/market-report/china-smartphone-market/85746/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.