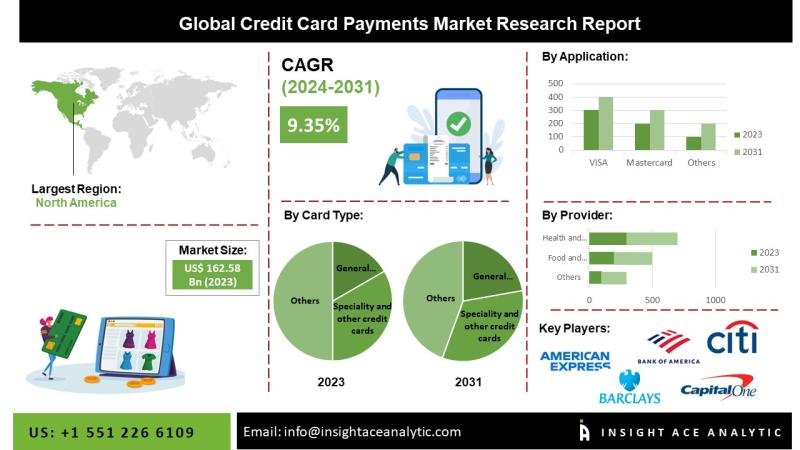

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Credit Card Payments Market Size, Share & Trends Analysis Report By Card Type (General Purpose Credit Cards and Specialty & Other Credit Cards), Application (Food & Groceries, Health & Pharmacy, Restaurants & Bars, Consumer Electronics, Media & Entertainment, Travel & Tourism and Others), and Provider (Visa, MasterCard, and Others)- Market Outlook And Industry Analysis 2031”

The global credit card payments market is estimated to reach over USD 327.68 billion by 2031, exhibiting a CAGR of 9.16% during the forecast period.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/1600

A credit card is a financial instrument issued to cardholders, enabling them to make payments to merchants for goods and services based on an accumulated line of credit. Credit cards are equipped with advanced security features that facilitate secure fund transfers between accounts, thereby driving increased consumer demand.

The global credit card market is experiencing significant growth, driven by the increasing preference for cashless transactions and the widespread availability of cost-effective credit card options. Furthermore, the rising adoption of credit cards among younger demographics in developing markets is contributing to the expansion of the sector. However, challenges such as the increasing incidence of credit card fraud globally are expected to restrain market growth. Nevertheless, technological advancements in product offerings, including the integration of blockchain technology to enhance security, are anticipated to create lucrative growth opportunities for the market over the forecast period.

List of Prominent Players in the Credit Card Payments Market:

• American Express

• Bank of America Corporation

• Barclays PLC

• Capital One

• Citigroup Inc.

• JPMorgan Chase & Co

• MasterCard

• Synchrony

• The PNC Financial Services Group, Inc.

• United Services Automobile Association

• Visa Inc.

Market Dynamics

Drivers:

The growing demand for non-cash payment alternatives for down payments and emergency expenses is a key factor driving market growth. Additionally, the increasing use of credit cards for purchasing consumer goods such as televisions, laptops, smartphones, travel packages, and jewelry is contributing to the expansion of the credit card payment market. The global availability of cost-effective credit cards further supports this upward trend. Moreover, technological advancements in blockchain are enhancing database security, strengthening consumer confidence in credit card transactions. Furthermore, certain companies are issuing specialized credit cards to employees for managing travel, meals, accommodation, and other expenses, thereby creating profitable growth opportunities for both end users and market investors.

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-02

Challenges:

The rising demand for alternative funding sources for down payments and emergency expenses is influencing market growth. However, the high cost associated with credit card products and the lack of consumer awareness regarding their benefits are key factors restraining market expansion during the forecast period. Furthermore, the impact of the COVID-19 pandemic on new credit card issuance is expected to hinder market growth. The economic slowdown has reduced consumer spending opportunities, leading to lower credit card debt levels and a decline in the registration of new credit cards.

Regional Trends:

The credit card payments market in North America is expected to secure a significant market share, driven by the increasing use of credit cards for online purchases. The Paycheck Protection Program, introduced by the U.S. government to promote digital payments, is also expected to support market expansion in North America. Additionally, the rising adoption of smartphones and tablets among consumers is anticipated to further drive market growth in the region. In Europe, the market holds a substantial share due to a well-established economy and increasing product adoption. The implementation of innovative strategies by key market players and growing collaboration among leading companies to strengthen market presence is expected to create opportunities for growth in the global credit card payments market.

Recent Developments:

• In March 2022-Fintech unicorn Razor pay revealed that it had paid an undisclosed sum to acquire IZealiant Technologies, a top startup that offers banks payment technology solutions. The acquisition of Azealia will assist Razor pay’s division of banking solutions to grow and enable it to develop cutting-edge payment banking technology for associate banks.

• In September 2021-Wizi was purchased by M2P, an Indian provider of digital infrastructure, for a $5 million transaction fee. With this merger, the businesses will oversee the credit card industry and benefit their clients. An Indian company called Wizz offers credit cards.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/1600

Segmentation of Credit Card Payments Market-

By Card Type

• General Purpose Credit Cards

• Specialty & Other Credit Cards

By Application

• Food & Groceries

• Health & Pharmacy

• Restaurants & Bars

• Consumer Electronics

• Media & Entertainment

• Travel & Tourism

• Others

By Provider

• Visa

• Mastercard

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.