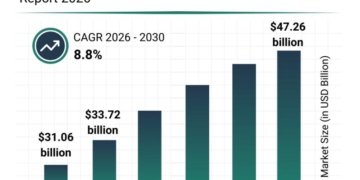

What Is the Expected Size and Growth Rate of the Loan Servicing Software Market?

The market size of loan servicing software has seen swift expansion in the last few years. The growth is projected to evolve from $3.7 billion in 2024 to $4.31 billion in 2025, marking a compound annual growth rate (CAGR) of 16.7%. Factors contributing to this noticeable growth during the historical period include heightened regulatory compliance obligations, higher demand for better efficiency and precision in loan management, escalated emergence of digital banking and fintech advancements, an increase in consumer demand for instantaneous account access, and the broadening of the mortgage and lending industry.

In the coming years, the loan servicing software market size is predicted to experience substantial growth, reaching a valuation of $7.89 billion in 2029 with a compound annual growth rate (CAGR) of 16.3%. The expansion anticipated in the forecasting period is driven by factors such as the growing demand for automation and enhanced efficiency in loan management procedures, increased uptake of cloud-based systems, mounting regulatory compliance stipulations, emphasis on customer experience, the booming fintech sector, and the need for advanced data security. Key trends for the forecast period encompass the adoption of cloud-based solutions, breakthroughs in automation and digitization, the incorporation of AI and machine learning for effective risk management, as well as innovations in mobile accessibility and user-centric interfaces.

What Are the Primary Growth Drivers for the Loan Servicing Software Market?

The loan servicing software market anticipates growth, propelled by the rise in non-performing loans. These are loans where borrowers are unable to make interest payments or principal repayments due to financial struggles. This surge in non-performing loans stems mainly from economic recession, augmenting unemployment, declining real estate value, elevated interest rates, and stress on borrower’s finances. Loan servicing software aids in efficiently managing these non-performing loans via automated surveillance, enhanced borrower communication, systematic collection activities, comprehensive risk assessment through data analysis, ensuring alignment with regulations, and detailed reporting to amplify recovery and minimizes financial ramifications. CEIC Data, a UK-based firm offering macroeconomic and sector-specific data, reported in March 2024 that the non-performing loan ratio in the United States had risen to 1.43% from 1.24% the previous year in 2023. Hence, this increase in non-performing loans is stimulating the expansion of the loan servicing software market.

Get Your Free Sample Now – Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=18662&type=smp

Which Leading Companies Are Shaping the Growth of the Loan Servicing Software Market?

Major companies operating in the loan servicing software market are Wipro Limited, Fidelity National Information Services, Constellation Software Inc., Sopra Banking Software SA, CoreLogic Inc., Temenos AG, ICE Mortgage Technology Inc., Q2 Holdings Inc., nCino Inc., Abrigo, Altisource Portfolio Solutions S.A., nCino Inc., Abrigo, Altisource Portfolio Solutions S.A., Nucleus Software Exports Ltd., Financial Industry Computer Systems Inc., Turnkey Lender Pte. Ltd., Calyx Software, The Mortgage Company, Shaw Systems Associates LLC, Cyrus Technoedge Solutions Pvt. Ltd., LendFoundry, Nortridge Software LLC, AutoPal Software, C Loans Inc

What Are the Major Trends Shaping the Loan Servicing Software Market?

The primary players in the loan servicing software market are concentrating on the development of pioneering solutions like loan management platforms. These solutions aim to increase efficiency, refine accuracy, and provide high-quality customer service. A loan management platform is an all-inclusive software solution purposed to simplify and mechanize the total loan procedure, from acquisition to servicing and repayment. Such platforms are utilized by financial organizations, credit unions, mortgage creditors, and further entities that offer loans, to regulate their lending practices efficiently. For example, Inovatec Systems, a company from Canada that specializes in innovative software solutions, launched its LMS 2.0 platform in April 2022. This novel loan management and servicing system aims to automate and simplify lender workflows. LMS 2.0 is configured to fit diverse loan and lease types, comprising secured and unsecured, multi-asset, student, balloon, and retail leases. Owning to its cloud-based framework designed for flexibility, efficacy, and user convenience, LMS 2.0 has emerged as an influential platform in the market.

What Are the Key Segments of the Loan Servicing Software Market?

The loan servicing software market covered in this report is segmented –

1) By Component: Software, Services

2) By Deployment Mode: Cloud-Based, On-Premises

3) By Enterprise Size: Large Enterprises, Small And Medium-Sized Enterprises

4) By End User: Banks, Credit Unions, Mortgage Lenders And Brokers, Other End-Users

Subsegments:

1) By Software: Loan Origination Software Or Loan Management Software Or Loan Collection Software Or Loan Default Management Software Or Loan Servicing Automation Software Or Customer Relationship Management (CRM) Software For Loan Servicing

2) By Services: Consulting Services Or Integration And Deployment Services Or Maintenance And Support Services

Pre-Book Your Report Now For A Swift Delivery:

https://www.thebusinessresearchcompany.com/report/loan-servicing-software-global-market-report

Which Region Dominates the Loan Servicing Software Market?

North America was the largest region in the loan servicing software market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the loan servicing software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

What Is Covered In The Loan Servicing Software Global Market Report?

– Market Size Analysis: Analyze the Loan Servicing Software Market size by key regions, countries, product types, and applications.

– Market Segmentation Analysis: Identify various subsegments within the Loan Servicing Software Market for effective categorization.

– Key Player Focus: Focus on key players to define their market value, share, and competitive landscape.

– Growth Trends Analysis: Examine individual growth trends and prospects in the Market.

– Market Contribution: Evaluate contributions of different segments to the overall Loan Servicing Software Market growth.

– Growth Drivers: Detail key factors influencing market growth, including opportunities and drivers.

– Industry Challenges: Analyze challenges and risks affecting the Loan Servicing Software Market.

– Competitive Developments: Analyze competitive developments, such as expansions, agreements, and new product launches in the market.

Unlock Exclusive Market Insights – Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18662

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.