HTF MI just released the Global Commercial Loan Software Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study’s segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Commercial Loan Software Market are:

nCino, Finastra, Temenos, FIS, Fiserv, Moody’s Analytics, Q2 Holdings, Abrigo, AFS Vision, CreditQuest, BankPoint, LoanPro, CloudBnq, Newgen Software, Wolters Kluwer, Lendio, Biz2X, Numerated, Sageworks, and Brilliance Financial Technology.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: (𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐅𝐮𝐥𝐥 𝐓𝐎𝐂, 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐓𝐚𝐛𝐥𝐞𝐬 & 𝐅𝐢𝐠𝐮𝐫𝐞𝐬, 𝐂𝐡𝐚𝐫𝐭) @

👉 https://www.htfmarketreport.com/sample-report/3957364-commercial-loan-software-market-1?utm_source=Altab_OpenPR&utm_id=Altab

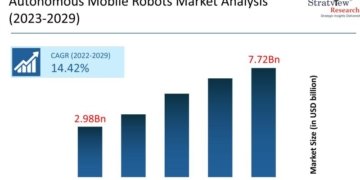

HTF Market Intelligence projects that the global Commercial Loan Software market will expand at a compound annual growth rate (CAGR) of 10.5% from 2025 to 2032, from 9 Billion in 2025 to 22 Billion by 2032.

Our Report Covers the Following Important Topics:

𝐁𝐲 𝐓𝐲𝐩𝐞:

Loan Origination Software, Credit Risk Management, Loan Servicing Software, Compliance & Reporting Software

𝐁𝐲 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧:

Banking, Financial Services, Mortgage Lending, SME Financing

Definition:

Commercial loan software automates the loan origination, underwriting, and servicing process for financial institutions. It streamlines credit risk management, ensures regulatory compliance, and enhances decision-making through AI-driven analytics.

Dominating Region:

North America

Fastest-Growing Region:

Asia-Pacific

Market Trends:

• AI-powered risk assessment, Blockchain integration for secure transactions, Cloud-based loan processing solutions

Market Drivers:

• Increasing demand for automation in loan processing, Rising regulatory compliance requirements, Growth of AI-driven credit assessment

Market Challenges:

• High implementation costs, Cybersecurity risks, Regulatory compliance complexity

Have a query? Market an enquiry before purchase 👉 👉 https://www.htfmarketreport.com/enquiry-before-buy/3957364-commercial-loan-software-market-1?utm_source=Altab_OpenPR&utm_id=Altab

The titled segments and sub-section of the market are illuminated below:

In-depth analysis of Commercial Loan Software market segments by Types: Loan Origination Software, Credit Risk Management, Loan Servicing Software, Compliance & Reporting Software

Detailed analysis of Career &Education Counselling market segments by Applications: Banking, Financial Services, Mortgage Lending, SME Financing

Global Commercial Loan Software Market -𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

• North America: United States of America (US), Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia, and Brazil.

• Middle East & Africa: Kingdom of Saudi Arabia, United Arab Emirates, Turkey, Israel, Egypt, and South Africa.

• Europe: the UK, France, Italy, Germany, Spain, Nordics, BALTIC Countries, Russia, Austria, and the Rest of Europe.

• Asia: India, China, Japan, South Korea, Taiwan, Southeast Asia (Singapore, Thailand, Malaysia, Indonesia, Philippines & Vietnam, etc.) & Rest

• Oceania: Australia & New Zealand

Buy Now Latest Edition of Commercial Loan Software Market Report 👉 https://www.htfmarketreport.com/buy-now?format=1&report=3957364?utm_source=Altab_OpenPR&utm_id=Altab

Commercial Loan Software Market Research Objectives:

– Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

– To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

– To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

– To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

– To deliberately profile the key players and systematically examine their growth strategies.

FIVE FORCES & PESTLE ANALYSIS:

Five forces analysis-the threat of new entrants, the threat of substitutes, the threat of competition, and the bargaining power of suppliers and buyers-are carried out to better understand market circumstances.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Get 10-25% Discount on Immediate purchase 👉 https://www.htfmarketreport.com/request-discount/3957364-commercial-loan-software-market-1?utm_source=Altab_OpenPR&utm_id=Altab

Points Covered in Table of Content of Global Commercial Loan Software Market:

Chapter 01 – Commercial Loan Software Executive Summary

Chapter 02 – Market Overview

Chapter 03 – Key Success Factors

Chapter 04 – Global Commercial Loan Software Market – Pricing Analysis

Chapter 05 – Global Commercial Loan Software Market Background or History

Chapter 06 – Global Commercial Loan Software Market Segmentation (e.g. Type, Application)

Chapter 07 – Key and Emerging Countries Analysis Worldwide Commercial Loan Software Market

Chapter 08 – Global Commercial Loan Software Market Structure & worth Analysis

Chapter 09 – Global Commercial Loan Software Market Competitive Analysis & Challenges

Chapter 10 – Assumptions and Acronyms

Chapter 11 – Commercial Loan Software Market Research Method Commercial Loan Software

Thank you for reading this post. You may also obtain report versions by area, such as North America, LATAM, Europe, Japan, Australia, or Southeast Asia, or by chapter.

Contact Us:

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

Connect with us on LinkedIn | Facebook | Twitter

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.