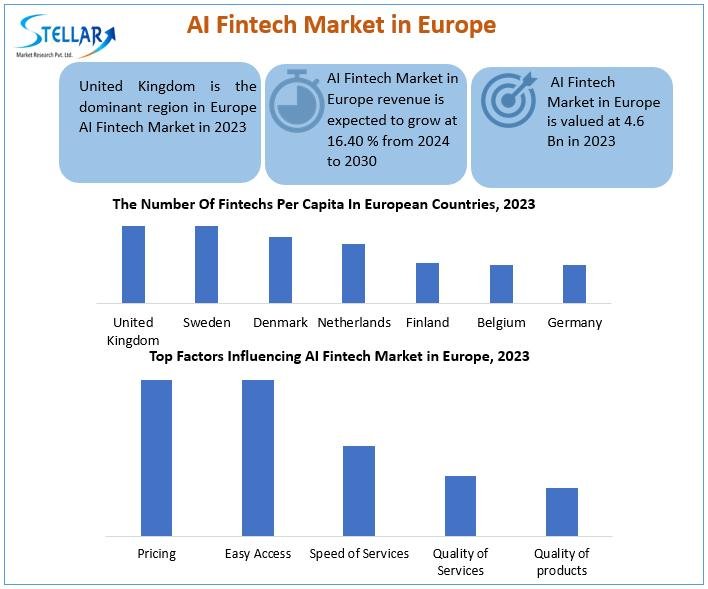

The 𝐀𝐈 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞 size in Europe was valued at USD 4.6 billion in 2023. With a projected compound annual growth rate (CAGR) of 16.40% from 2024 to 2030, the market is expected to reach nearly USD 22.47 billion by 2030. This substantial growth highlights the increasing adoption of artificial intelligence technologies in the fintech industry, enabling organizations to enhance efficiency and improve financial services.

𝐀𝐈 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

Artificial intelligence has revolutionized the fintech industry in Europe by automating routine procedures, preventing fraud, and delivering outcomes that surpass human capabilities. By leveraging AI, fintech companies have been able to enhance operational efficiency, identify risks, and boost profitability. The market is driven by technological advancements, progressive regulations, and a growing demand for digital transformation across the region. Additionally, AI-powered applications in fintech, such as predictive analytics, customer personalization, and process optimization, are reshaping the financial services landscape.

𝐖𝐚𝐧𝐭 𝐭𝐨 𝐒𝐞𝐞 𝐭𝐡𝐞 𝐓𝐫𝐞𝐧𝐝𝐬? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲:https://www.stellarmr.com/report/req_sample/AI-Fintech-Market-in-Europe/1692

𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐀𝐈 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞:

The increasing influence of artificial intelligence in fintech is a significant market driver. AI enables financial firms to reduce costs, enhance productivity, and deliver improved services to customers. The rising adoption of cognitive process automation allows for handling complex tasks, boosting operational efficiency. Furthermore, the shift towards digital payments and the integration of AI in banking apps have transformed financial management for users by simplifying transactions and offering personalized financial insights. The convenience and efficiency provided by AI-powered solutions continue to attract a broader user base in Europe.

𝐀𝐈 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞 𝐓𝐫𝐞𝐧𝐝𝐬:

Emerging trends in the European AI fintech market include the growing integration of advanced analytics to enhance decision-making processes and the adoption of personalized financial services driven by AI insights. The evolution of mobile-based fintech services is another significant trend, driven by increasing smartphone penetration and demand for digital financial solutions. Moreover, strategic partnerships and collaborations, such as KPMG UK’s alliance with Databricks for generative AI innovation, highlight the growing focus on leveraging AI to gain competitive advantages. The market is also witnessing a rise in venture capital investments, particularly in the United Kingdom, strengthening the fintech ecosystem across Europe.

𝐓𝐡𝐞 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐒𝐭𝐚𝐤𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬 𝐜𝐚𝐧 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐟𝐨𝐫 𝐭𝐡𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:https://www.stellarmr.com/report/enquire_now/AI-Fintech-Market-in-Europe/1692

𝐀𝐈 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞 𝐃𝐲𝐧𝐚𝐦𝐢𝐜𝐬 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞

The AI Fintech market in Europe is experiencing robust growth driven by rapid digital transformation and increasing adoption of artificial intelligence across financial services. European fintech firms are leveraging AI for predictive analytics, fraud detection, customer behavior analysis, and personalized financial products, enhancing operational efficiency and customer experience. Regulatory frameworks such as GDPR emphasize data privacy, influencing AI deployment strategies in the region. Key trends include the rise of AI-powered digital banking solutions, algorithmic trading platforms, and automated credit scoring systems. Collaboration between fintech startups and traditional financial institutions, alongside government initiatives promoting innovation, is further propelling market expansion in Europe.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐮𝐥𝐥 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 @https://www.stellarmr.com/report/req_sample/AI-Fintech-Market-in-Europe/1692

𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐀𝐈 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞:

By Deployment Mode

On-premises

Cloud-based

By Application

Virtual Assistants

Business Analytics and Reporting

Customer Behavioral Analytics

Fraud Detection

Quantitative and Asset Management

Other

By End User

Banking

Insurance

Securities

𝐅𝐨𝐫 𝐦𝐨𝐫𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐚𝐛𝐨𝐮𝐭 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐯𝐢𝐬𝐢𝐭:https://www.stellarmr.com/report/AI-Fintech-Market-in-Europe/1692

𝐖𝐡𝐨 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐚𝐫𝐠𝐞𝐬𝐭 𝐦𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫𝐬 𝐨𝐟 𝐀𝐈 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐢𝐧 𝐄𝐮𝐫𝐨𝐩𝐞 𝐰𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞?

Revolut – UK

Adyen – Netherlands

Funding Circle – UK

TransferWise (Wise) UK

Monzo – UK

N26 -Germany

Klarna – Sweden

Checkout.com – UK

OakNorth – UK

Lemonade – Netherlands

iZettle (now PayPal) – Sweden

Raisin -Germany

Nutmeg – UK

Onfido – UK

ComplyAdvantage – UK

Curve – UK

Starling Bank – UK

Zopa – UK

Atom Bank – UK

TransferGo – UK

AirBank

Finleap Connect

Finanzcheck.de

Raisin DS

N26

wefox Group

Pendix

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐒𝐭𝐞𝐥𝐥𝐚𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

♦ Blood Glucose Monitoring Devices Market https://www.stellarmr.com/report/Blood-Glucose-Monitoring-Devices-Market/1360

♦ Diagnostics PCR Market https://www.stellarmr.com/report/Diagnostics-PCR-Market/1361

♦ Food for Special Medical Purpose Market https://www.stellarmr.com/report/Food-for-Special-Medical-Purpose-Market/1362

♦ Portable Dishwasher Market https://www.stellarmr.com/report/Portable-Dishwasher-Market/1363

♦ Bone Metastasis Market https://www.stellarmr.com/report/Bone-Metastasis-Market/1364

♦ Dried Vegetable Market https://www.stellarmr.com/report/Dried-Vegetable-Market/1365

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐒𝐭𝐞𝐥𝐥𝐚𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

sales@stellarmr.com

𝐀𝐛𝐨𝐮𝐭 𝐒𝐭𝐞𝐥𝐥𝐚𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.