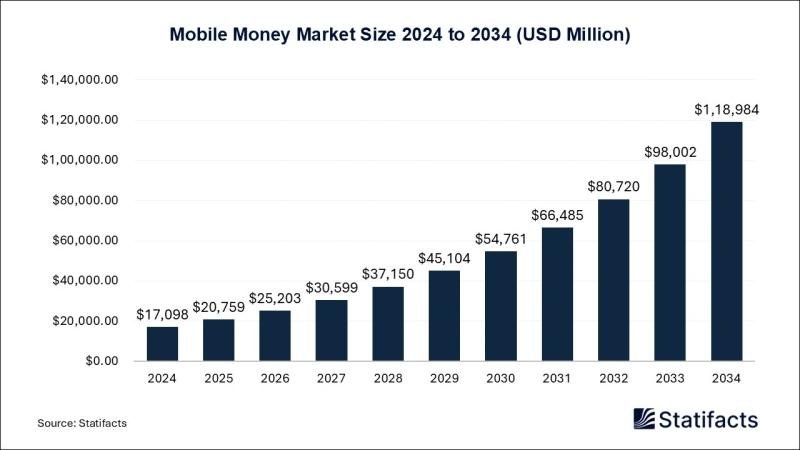

Price- USD 1550, According to Statifacts, The global mobile money market size was valued at USD 17,098 million in 2024 and is estimated to hit around USD 1,18,984 million by 2034, growing at a CAGR of 21.41% from 2024 to 2034.

𝐕𝐢𝐞𝐰 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐃𝐚𝐭𝐚𝐬𝐞𝐭@ https://www.statifacts.com/outlook/mobile-money-market

The mobile money market has witnessed significant growth over the past decade, driven by the increasing penetration of smartphones and the widespread adoption of digital financial services. Mobile money refers to financial transactions and services conducted through mobile devices, enabling users to store, send, and receive money digitally without the need for traditional banking infrastructure. This market has revolutionized financial inclusion, especially in emerging economies where access to traditional banking services remains limited. Key players in the mobile money ecosystem include mobile network operators (MNOs), financial institutions, fintech companies, and regulatory bodies, all working together to provide seamless and secure financial services. Mobile money services encompass various functionalities, including person-to-person (P2P) transfers, bill payments, international remittances, merchant payments, and micro-financing.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐭𝐡𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬@ https://www.statifacts.com/download-product/7420

𝐆𝐫𝐨𝐰𝐭𝐡 𝐅𝐚𝐜𝐭𝐨𝐫𝐬

Several factors are driving the growth of the mobile money market, with technological advancements and changing consumer behavior playing pivotal roles. The increasing adoption of smartphones and internet connectivity, particularly in developing regions, has provided a solid foundation for mobile money expansion. Additionally, the rise of cashless transactions and government initiatives promoting digital financial inclusion have further propelled market growth. The COVID-19 pandemic accelerated the shift towards contactless payments, enhancing the demand for mobile money solutions as people sought safer and more convenient alternatives to physical cash. Furthermore, the growing reliance on e-commerce and the need for efficient cross-border remittance solutions have contributed to the market’s expansion. Strategic partnerships between mobile money service providers and financial institutions have also helped in expanding the service portfolio and reaching a broader customer base.

𝐀𝐈 𝐈𝐦𝐩𝐚𝐜𝐭

Artificial intelligence (AI) is playing a transformative role in the mobile money market by enhancing efficiency, security, and customer experience. AI-driven algorithms are being deployed to analyze user behavior, detect fraudulent transactions, and provide personalized financial recommendations. Machine learning models help in risk assessment, ensuring regulatory compliance while reducing operational costs. AI-powered chatbots and virtual assistants are improving customer service by offering instant support and facilitating seamless transactions. Moreover, predictive analytics enabled by AI can help mobile money providers identify market trends, optimize pricing strategies, and develop targeted marketing campaigns. As AI technology continues to evolve, its integration into mobile money platforms is expected to drive further innovation, increase operational efficiency, and enhance user trust.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥

The mobile money market holds immense potential, particularly in regions with large unbanked and underbanked populations such as Africa, Asia-Pacific, and Latin America. With increasing smartphone penetration and expanding internet connectivity, mobile money services are becoming a critical tool for financial inclusion. Governments and financial institutions are increasingly investing in digital payment infrastructure and regulatory frameworks to support the adoption of mobile financial services.

The demand for convenient, low-cost, and secure financial solutions is driving innovation, with services such as peer-to-peer (P2P) transfers, microloans, and digital savings accounts gaining traction. Furthermore, the integration of mobile money with e-commerce, healthcare, and agricultural sectors is creating new opportunities for market expansion. The rising popularity of QR code payments, mobile wallets, and cross-border remittance solutions is also contributing to the market’s potential for sustained growth in the coming years.

𝐂𝐡𝐞𝐜𝐤 𝐨𝐮𝐭 𝐨𝐮𝐫 𝐭𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐬𝐭𝐮𝐝𝐢𝐞𝐬 𝐭𝐨 𝐮𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐢𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐬𝐡𝐢𝐟𝐭𝐬 :

⬧︎ Fish Powder Market@ https://www.statifacts.com/outlook/fish-powder-market

⬧︎ Kraft Bubble Mailer Market@ https://www.statifacts.com/outlook/kraft-bubble-mailer-market

⬧︎ Dual Containment Pipe Market@ https://www.statifacts.com/outlook/dual-containment-pipe-market

𝐅𝐮𝐭𝐮𝐫𝐞 𝐎𝐮𝐭𝐥𝐨𝐨𝐤

Looking ahead, the mobile money market is expected to continue its rapid expansion, fueled by ongoing technological advancements, regulatory support, and evolving consumer preferences. The adoption of 5G technology and the development of blockchain-based solutions are anticipated to enhance transaction speed, security, and transparency.

Additionally, AI-driven innovations in fraud detection, customer engagement, and personalized financial services will further boost market growth. As digital ecosystems evolve, mobile money services are likely to expand beyond traditional banking functions to include insurance, investment, and wealth management solutions. However, challenges such as cybersecurity threats, interoperability issues, and regulatory complexities must be addressed to ensure a seamless and secure mobile money experience. Overall, the market presents significant opportunities for service providers, financial institutions, and fintech companies to drive financial empowerment and economic growth globally.

𝐁𝐮𝐲 𝐭𝐡𝐢𝐬 𝐃𝐚𝐭𝐚𝐛𝐨𝐨𝐤@ https://www.statifacts.com/order-report/7420

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here – https://www.statifacts.com/get-a-subscription

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬:

Ballindamm 22, 20095 Hamburg, Germany

sales@statifacts.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and customer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

𝐕𝐢𝐬𝐢𝐭 𝐎𝐮𝐫 𝐒𝐢𝐭𝐞𝐦𝐚𝐩: https://www.statifacts.com/outlook/sitemap.xml

This release was published on openPR.