Fraud is a major concern for businesses and financial institutions worldwide. As the global economy becomes increasingly digital, fraudsters are employing more sophisticated techniques to exploit vulnerabilities. In response, fraud detection and prevention systems are evolving rapidly, providing organizations with the tools needed to mitigate risks and protect both consumers and businesses. In this article, we explore the fraud detection and prevention market, its growth, trends, and key drivers.

Introduction

The fraud detection and prevention market refers to the technologies, software, and services designed to detect and prevent fraudulent activities across various sectors such as banking, insurance, healthcare, retail, and government. Fraudulent activities such as identity theft, payment fraud, cyber-attacks, and financial fraud are on the rise, making it essential for companies to invest in fraud detection and prevention solutions. These technologies utilize machine learning, artificial intelligence, big data, and analytics to identify suspicious activities, predict potential threats, and mitigate risks before they escalate.

The market for fraud detection and prevention is witnessing rapid growth due to the increasing adoption of digital technologies, the rise in fraud cases, and the need for businesses to comply with regulatory requirements. These solutions help businesses avoid financial losses, protect customer data, and maintain their reputation in the competitive marketplace.

Market Size

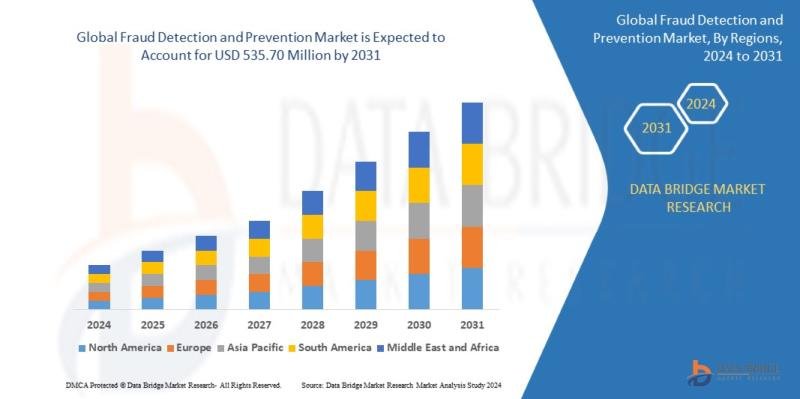

The global fraud detection and prevention market size was valued at USD 221.84 million in 2023 and is projected to reach USD 535.70 million by 2031, with a CAGR of 11.65% during the forecast period of 2024 to 2031. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

For More Information-https://www.databridgemarketresearch.com/reports/global-fraud-detection-and-prevention-market

This growth can be attributed to several factors, including the increasing adoption of digital payment systems, the expansion of e-commerce, and the growing need for organizations to protect sensitive data from cyber threats. Moreover, the COVID-19 pandemic has accelerated the shift towards online transactions and remote work, resulting in a surge in digital fraud incidents. Consequently, the demand for fraud detection and prevention solutions has risen across industries, particularly in sectors like banking, financial services, and insurance (BFSI), retail, and healthcare.

Market Share

The fraud detection and prevention market is highly competitive, with several key players contributing to its expansion. The market is segmented into software and services, with software solutions dominating the market share due to their ability to automate fraud detection processes and provide real-time monitoring. The key players in the market include established names like IBM Corporation, SAS Institute Inc., FICO, ACI Worldwide, and ThreatMetrix, among others.

North America currently holds the largest market share, owing to the early adoption of advanced fraud detection technologies, a strong presence of key industry players, and stringent regulatory frameworks. The region is home to a large number of financial institutions, e-commerce companies, and government agencies, all of which require robust fraud prevention systems. Europe follows closely, with a significant share driven by the rising adoption of digital payment solutions and increased instances of payment fraud.

Asia Pacific is expected to experience the highest growth rate during the forecast period. The rapid digitalization of economies in countries like China, India, and Japan is fueling the demand for fraud detection and prevention solutions. Moreover, the increasing number of mobile payment users and growing online transactions are prompting businesses in the region to invest in fraud prevention technologies.

The Evolution of Fraud Detection and Prevention

Fraud detection and prevention technologies have come a long way since their inception. Initially, fraud detection systems relied on rule-based algorithms that were effective for detecting known patterns of fraudulent activities. However, as fraudsters became more sophisticated, these traditional systems struggled to keep up. The limitations of rule-based systems led to the development of more advanced techniques, such as machine learning (ML) and artificial intelligence (AI).

Machine learning algorithms are now widely used in fraud detection systems to analyze vast amounts of data and identify hidden patterns that may indicate fraudulent activity. These algorithms can continuously learn and adapt to new fraud tactics, making them highly effective in detecting emerging threats. AI-powered fraud detection systems can process large volumes of data in real time, offering more accurate and timely alerts.

Additionally, the integration of big data analytics has further enhanced the capabilities of fraud detection systems. By analyzing structured and unstructured data from various sources, businesses can gain deeper insights into potential risks and vulnerabilities. Advanced analytics can help identify behavioral anomalies, patterns, and trends, enabling businesses to take proactive measures against fraud.

The rise of biometrics, including facial recognition and fingerprint scanning, has also contributed to the evolution of fraud prevention. These technologies add an extra layer of security, making it more difficult for fraudsters to access sensitive information. Multi-factor authentication (MFA) has become a standard security measure in many industries, providing an additional barrier to unauthorized access.

Market Trends

Several key trends are shaping the fraud detection and prevention market:

AI and Machine Learning Integration: Artificial intelligence and machine learning are increasingly being integrated into fraud detection solutions to improve accuracy and efficiency. These technologies enable systems to automatically detect and respond to fraudulent activities in real time, reducing the need for manual intervention and enhancing overall system performance.

Cloud-Based Fraud Prevention Solutions: Cloud computing has gained significant traction in the fraud detection and prevention market due to its scalability, flexibility, and cost-effectiveness. Cloud-based solutions allow businesses to access fraud detection tools remotely, reducing the need for on-premise infrastructure and enabling quicker updates and maintenance.

Real-Time Monitoring and Alerts: Real-time monitoring and alert systems are becoming more prevalent as businesses seek to minimize the impact of fraud. Real-time fraud detection solutions allow organizations to monitor transactions as they occur and respond to suspicious activities instantly, minimizing potential losses.

Regulatory Compliance: Regulatory compliance is a major driver for the adoption of fraud detection and prevention solutions. In sectors like BFSI and healthcare, businesses must adhere to strict regulations such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS). These regulations mandate the implementation of robust fraud prevention measures, driving market growth.

Mobile Fraud Prevention: With the increasing use of mobile payments, mobile fraud is becoming a significant concern. Fraud detection solutions tailored for mobile platforms, including device fingerprinting, geolocation tracking, and biometric authentication, are in high demand.

Factors Driving Market Growth

Several factors are contributing to the growth of the fraud detection and prevention market:

Rising Fraud Incidents: As fraud becomes more prevalent, businesses are investing in advanced fraud detection solutions to protect themselves from financial losses and reputational damage. The increasing sophistication of fraud schemes, including cyber-attacks and payment fraud, is driving demand for more effective prevention methods.

Digital Transformation: The digitalization of financial services, e-commerce, and other sectors has expanded the attack surface for fraudsters. As organizations transition to digital platforms, they need to implement robust fraud detection systems to protect themselves and their customers from potential threats.

Growing Cybersecurity Concerns: The increasing number of data breaches and cyberattacks is prompting organizations to adopt comprehensive fraud detection and prevention measures. With cybercriminals becoming more adept at exploiting vulnerabilities, businesses are prioritizing the protection of sensitive information.

Customer Expectations: As consumers demand seamless and secure digital experiences, businesses are under pressure to offer secure payment systems and protect personal data. Fraud detection solutions help organizations meet these expectations while maintaining a high level of security.

Government Regulations: Governments worldwide are introducing stricter regulations to combat fraud and ensure consumer protection. Compliance with these regulations requires businesses to adopt advanced fraud detection and prevention solutions, thereby driving market growth.

Browse Trending Reports:

https://rutujabhosaleblogs.blogspot.com/2024/12/surgical-instrument-tracking-systems_10.html

https://rutujabhosaleblogs.blogspot.com/2024/12/fraud-detection-and-prevention-market.html

https://rutujabhosaleblogs.blogspot.com/2024/12/espresso-coffee-market-size-share_10.html

https://rutujabhosaleblogs.blogspot.com/2024/12/impact-modifier-market-size-share.html

Conclusion

The fraud detection and prevention market is evolving rapidly in response to increasing fraud risks and the growing demand for secure digital transactions. With advancements in AI, machine learning, big data analytics, and biometrics, businesses are better equipped to identify and prevent fraudulent activities. The market is expected to continue growing at a significant pace, driven by factors such as rising fraud incidents, digital transformation, and the need for regulatory compliance. As technology continues to advance, the future of fraud detection and prevention holds promising opportunities for both businesses and consumers.

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com

This release was published on openPR.