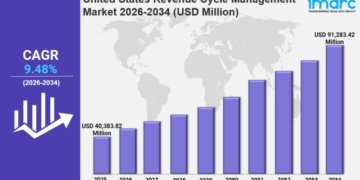

The renewable energy insurance market, a critical support industry for the global shift toward sustainable energy sources, was valued at approximately USD 16,452 million in 2022. As renewable energy projects grow in size, complexity, and global reach, so does the demand for specialized insurance to mitigate associated risks. The market is expected to increase from USD 17,856.2 million in 2023 to USD 24,569.3 million by 2032, reflecting a compound annual growth rate (CAGR) of around 4.02% from 2024 to 2032. This steady growth is driven by the rapid expansion of the renewable energy sector, regulatory support, and evolving risk management needs.

Key Companies in the Renewable Energy Insurance Market Include:

Swiss Re, Marsh McLennan, Lloyd’s of London, Munich Re, XL Catlin, Everest Reinsurance, Chubb, Willis Towers Watson, Allianz, Zurich Insurance Group, AXA XL, American International Group (AIG), Liberty Mutual Insurance, RSA Insurance Group

Get a FREE Sample Report PDF Here: https://www.marketresearchfuture.com/sample_request/23063

Key Market Drivers

Expansion of Renewable Energy Projects

The global push for renewable energy adoption is accelerating the development of solar, wind, hydroelectric, and other green energy projects. These projects require substantial upfront investment and are often situated in challenging environments, leading to unique risks such as weather-related damage, equipment failure, and long construction timelines. Specialized insurance helps to manage these risks, making the expansion of renewable energy feasible and financially viable.

Government Initiatives and Regulatory Support

Many governments around the world have implemented policies, subsidies, and tax incentives to encourage renewable energy investment. These regulatory frameworks not only promote project development but also increase the demand for renewable energy insurance to comply with policy requirements and mitigate financial exposure. As countries strive to meet emissions reduction targets and transition to cleaner energy, insurance products tailored to this industry will remain essential.

Technological Advancements in Renewable Energy

With advancements in technology, renewable energy systems are becoming more efficient and affordable. However, these innovations also introduce new types of risks, such as cyber threats to smart grid systems or technical malfunctions in high-tech equipment. The complexity of insuring renewable energy projects has increased, driving demand for specialized insurance products to cover both traditional and emerging risks associated with modern technology.

Rising Awareness of Climate-Related Risks

Climate change is creating more extreme weather patterns, which directly impact renewable energy projects, particularly those in vulnerable areas. For instance, offshore wind farms are exposed to storms, while solar panels face risks from hail and extreme temperatures. The increasing frequency and severity of weather-related events have made insurance a vital component of renewable energy projects, providing a safety net that supports continued investment and growth.

Growing Investment from Private and Institutional Investors

As investors become more aware of the environmental impact of their portfolios, renewable energy has gained favor as a socially responsible investment. Institutional investors, including pension funds and asset managers, are allocating more capital to renewable energy projects, and they often require insurance to protect their investments. This trend is driving demand for renewable energy insurance policies that cover construction, operational risks, and liability.

Market Challenges

Despite promising growth, the renewable energy insurance market faces some challenges that could influence its trajectory:

High Cost of Premiums: Insuring renewable energy projects can be costly due to the inherent risks, which may include environmental hazards and equipment failures. Premiums can strain project budgets, especially for smaller developers, potentially impacting overall demand for insurance coverage.

Limited Historical Data for Risk Assessment: Unlike traditional industries, the renewable energy sector is relatively new, which limits the historical data available for insurers to accurately assess risks. This lack of data can lead to conservative underwriting, higher premiums, and restricted coverage options.

Regulatory and Policy Uncertainty: Changes in government policies or subsidies can impact project feasibility and, by extension, the demand for insurance. Uncertainty surrounding renewable energy policy shifts in certain regions may affect investor confidence and insurance needs.

Regional Market Insights

North America

The North American renewable energy insurance market is strong, with the U.S. and Canada leading the charge in renewable energy installations. Government incentives, corporate commitments to sustainability, and increasing investments in offshore wind and solar projects are driving demand for renewable energy insurance. The region’s focus on innovation and regulatory compliance contributes to the need for specialized insurance products.

Europe

Europe is a mature market for renewable energy insurance due to its established renewable energy infrastructure and supportive regulatory environment. Countries such as Germany, the UK, and the Netherlands are investing heavily in offshore wind projects, which require complex insurance coverage. Europe’s emphasis on sustainability, carbon reduction targets, and technological advancements in energy production supports continued demand for renewable energy insurance.

Asia-Pacific

Asia-Pacific is expected to witness the fastest growth in the renewable energy insurance market due to rapid energy transition initiatives in countries like China, India, Japan, and South Korea. With significant solar and wind power potential, Asia-Pacific presents a lucrative market for insurers as more projects emerge. However, natural disaster risks, particularly in regions prone to typhoons and earthquakes, increase the demand for robust insurance coverage.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are emerging markets for renewable energy insurance. In Latin America, large-scale hydropower and solar projects are being developed to meet the energy needs of growing populations. In the Middle East & Africa, countries are increasingly investing in solar energy as part of their diversification efforts. These regions show growth potential, but challenges like political instability and limited insurance penetration could impact market expansion.

Know More about the renewable energy insurance Market Report: https://www.marketresearchfuture.com/reports/renewable-energy-insurance-market-23063

Market Forecast and Future Outlook

The projected CAGR of 4.02% from 2024 to 2032 indicates steady growth in the renewable energy insurance market. Insurance solutions that address construction risks, operational liabilities, and cyber threats will be essential for the continued expansion of renewable energy projects. As the energy transition accelerates globally, insurance companies are likely to develop more tailored products that address the unique needs of the renewable energy sector.

Key Players and Competitive Landscape

The renewable energy insurance market is dominated by a mix of traditional insurers and specialized firms. Key players in the market include:

Allianz Global Corporate & Specialty: A major provider of renewable energy insurance, covering a range of risks associated with wind, solar, and hydroelectric projects.

AXA XL: Offers extensive insurance solutions for renewable energy, including coverage for project construction and operational phases.

Munich Re: Known for risk assessment expertise, Munich Re provides insurance for renewable energy assets and is heavily involved in offshore wind and solar insurance.

Zurich Insurance Group: Provides comprehensive renewable energy insurance policies, emphasizing risk prevention and management.

These companies are continuously innovating to offer insurance products that address the evolving risk landscape associated with renewable energy projects.

Top Trending Research Report:

Digital Payment Healthcare Market https://www.marketresearchfuture.com/reports/digital-payment-healthcare-market-7977

Automotive Insurance Market https://www.marketresearchfuture.com/reports/automotive-insurance-market-7793

Online Payment Gateway Market https://www.marketresearchfuture.com/reports/online-payment-gateway-market-6347

BFSI Security Market https://www.marketresearchfuture.com/reports/bfsi-security-market-1810

Account Payable Market https://www.marketresearchfuture.com/reports/account-payable-market-8683

Anti Money Laundering Solutions Market https://www.marketresearchfuture.com/reports/anti-money-laundering-solutions-market-24771

Crypto Payment Gateway Market https://www.marketresearchfuture.com/reports/crypto-payment-gateway-market-24736

B2C Payment Market https://www.marketresearchfuture.com/reports/b2c-payment-market-29051

Blockchain Finance Market https://www.marketresearchfuture.com/reports/blockchain-finance-market-28798

Business Analytics In Fintech Market https://www.marketresearchfuture.com/reports/business-analytics-in-fintech-market-29077

About Market Research Future:

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.