- Initiated the transition to a global publishing business powered by proprietary, world-class SEO technology

- Completed operational cost-cutting and product automation

- Finalized strategy to enter enterprise publishing, targeting high-value niche content sites

PERTH, Australia, Nov. 12, 2024 (GLOBE NEWSWIRE) — Locafy Limited (Nasdaq: LCFY, LCFYW) (“Locafy” or the “Company”), a globally recognized software-as-a-service technology company specializing in ”entity-based” search engine optimization (SEO), today reported financial results for the 2025 fiscal first quarter ended September 30, 2024. All financial results are reported in Australian Dollars (AUD).

Operational Highlights

Achieved several key technology and product milestones that lay the groundwork for revenue growth in fiscal 2025, including:

- Successfully integrated Article publishing solution into the Locafy platform. Previously, the Article Accelerator technology was applied to third-party websites that published their articles, which Locafy then “boosted.” However, this approach was no longer viable due to Google’s recent enforcement of penalties for site abuse. Now, Locafy can create, publish, and boost articles within its ecosystem to achieve national search prominence using proprietary technology and expertise.

- Identified a market opportunity to create locally focused business articles utilizing business listing content from its directories and publishing partners connected via its application program interface (API). The production of a prototype solution was successfully completed, leveraging generative artificial intelligence (AI) to automate article creation and publishing on Locafy’s assets. Initial test articles achieved Page 1 rankings for target keywords within 30 days.

- Revitalized scoop.com.au, an online directory specializing in the travel, entertainment, and lifestyle sectors, which was acquired earlier in 2024. With a strong Moz Domain Authority of 36, over 48,000 backlinks (including approximately 5,000 from Wikipedia and prior rankings for more than 170,000 organic keywords), scoop.com.au presented an important asset. Leveraging this quality and Locafy’s technology, more than 600,000 pages with contextually relevant content were indexed in under 30 days. Locafy intends to apply insights from this process to its other niche content and directory publishing assets.

Management Commentary

“Our operational progress during the quarter has established a strong foundation for the remainder of the fiscal year,” said Locafy CEO Gavin Burnett. “We believe that we have officially transitioned to a global publishing business powered by proprietary SEO technology that drives online prominence for our customers’ content in organic search results across local and national markets.

“At the local level, we’re leveraging our quality directory assets and publishing partnerships to create and deploy local SEO products in a highly automated way. Our extensive network of publishing partners provides quality business listing content that we can now convert into valuable local SEO products, including landing pages and articles, with an automated approach.

“After extensive testing, our local landing page solutions have shown promising results. The next step is to generate these landing pages using our partners’ business listings as source content.

“Further, we’ve developed a prototype solution using generative AI to produce high-quality, locally focused business articles. This prototype utilizes the same individual business listings used for landing pages. In testing, these articles ranked on Page 1 for valuable keyword and location combinations within 30 days—a result we’re thrilled with.

“In short, our goal is to empower any partner that publishes business listings via our API to generate both landing pages and article products automatically. We believe this will create a new revenue stream for them and drive recurring revenue for us.

“On the enterprise level, we’re excited to enter the publishing arena with niche content sites where we can use our Article Accelerator technology to achieve national prominence in search results for competitive, high-value keywords on behalf of our clients. Our strategy will focus on high-value business categories to maximize our return on investment.

“Looking ahead, we expect the full impact of our technology and automation to drive accelerated growth in the coming quarters, enabling us to expand our market reach and strengthen our recurring revenue streams.”

2025 Fiscal First Quarter Financial Results

Results compare the 2025 fiscal first quarter end (September 30, 2024) to the 2024 fiscal first quarter end (September 30, 2023) unless otherwise indicated. All financial results are reported in Australian Dollars (AUD).

- Total operating revenue decreased 27.8% to $785,000 from $1.1 million in the comparable year-ago period.

- Subscription revenue decreased 25.6% to $731,000 from $981,000 in the comparable year-ago period. Compared to the 2024 fiscal fourth quarter, subscription revenue remained steady.

- Advertising revenue decreased 60.3% to $39,000 from $97,000 in the comparable year-ago period. Compared to the 2024 fiscal fourth quarter, advertising revenue remained steady.

- Services revenue increased 80.3% to $16,000, up from $9,000 in the comparable period last year. However, compared to the fourth quarter of fiscal 2024, services revenue decreased by 96.3%, reflecting the completion of significant services projects during that period. Locafy anticipates that services revenue for the first quarter of fiscal 2025 reflects its near-term outlook, as the Company shifts resources toward developing and monetizing its own online publications rather than those owned by third parties.

- Other income was $662,000 from $0 in the comparable year-ago period. The variance is attributed to the Company’s recent assessment (in conjunction with guidance received from professional consultants) of the extent and likelihood of its ability to claim a Research & Development tax incentive in Australia, as was possible in prior years. The amount recognized in the 2025 fiscal first quarter is based on an estimate of the claimable value from expenditure incurred during the 2024 fiscal year and an estimate of the claimable value of expenditure incurred during the 2025 fiscal first quarter itself.

- Operating expenses decreased 22.5% to $1.5 million from $1.9 million in the comparable year-ago period. This is primarily due to a 51.0% decrease in employment-related expenses to $454,000 from $927,000, a 35.5% decrease in consultancy expenses to $152,000 from $235,000, and offset by a 25.7% increase in amortization expenses to $452,000 from $360,000.

- Net loss was $55,000, or $0.04 per diluted share, compared to a net loss of $808,000, or $0.63 per diluted share, in the comparable year-ago period.

Key Performance Indicators (KPIs)

As part of its updated go-to-market strategy, Locafy has shifted its focus from traditional KPIs, which are no longer seen as adequate indicators of long-term success. The Company now prioritizes Monthly Recurring Revenue (MRR) as the key measure of performance across its platform. Unless otherwise stated, KPI data is as of the fiscal first quarter of 2025 (ended June 30, 2025).

- Monthly recurring revenue (MRR) for the 2025 fiscal first quarter was $256,000, a 28.7% decrease from the comparable year-ago period and a slight increase compared to the 2024 fiscal first quarter.

For more information, please see Locafy’s investor relations website at investors.locafy.com.

About Locafy

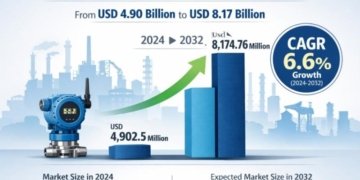

Founded in 2009, Locafy’s (Nasdaq: LCFY, LCFYW) mission is to revolutionize the US$700 billion SEO sector. We help businesses and brands increase search engine relevance and prominence in a specific proximity using a fast, easy, and automated approach. For more information, please visit http://www.locafy.com.

About Key Performance Indicators

Locafy defines MRR as the value of all recurring subscription contracts with active entitlements as at the end of each month. MRR across a period is the average of each month’s MRR within that period.

Locafy’s recent platform upgrade caused a significant change to the calculation of average page metrics, and Locafy management no longer views total active reseller count and total end user count as relevant indicators of the performance of Locafy’s technology. The Company may introduce additional KPIs in future quarters if deemed relevant long-term indicators of performance.

Forward-Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “subject to”, “believe,” “anticipate,” “plan,” “expect,” “intend,” “estimate,” “project,” “may,” “will,” “should,” “would,” “could,” “can,” the negatives thereof, variations thereon and similar expressions, or by discussions of strategy, although not all forward-looking statements contain these words. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, they do involve assumptions, risks, and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors and risk factors, including those discussed in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including the Company’s Annual Report on Form 20-F filed with the SEC on November 12, 2024, and available on its website (http://www.sec.gov). All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these factors. Other than as required under the securities laws, the Company does not assume a duty to update these forward-looking statements.

Investor Relations Contact

Matt Glover or Matt Szot

Gateway Investor Relations

(949) 574-3860

LCFY@gateway-grp.com

| -Financial Tables to Follow- | |||||||||

| Locafy Limited Consolidated Statement of Profit or Loss and Other Comprehensive Income (Unaudited) | |||||||||

| 3 months to 30 Sep 2024 AUD $ | 3 months to 30 Sep 2024 AUD $ | ||||||||

| Revenue | 785,166 | 785,166 | |||||||

| Other income | 661,516 | 661,516 | |||||||

| Technology expense | (312,484 | ) | (312,484 | ) | |||||

| Employee benefits expense | (454,422 | ) | (454,422 | ) | |||||

| Occupancy expense | (27,761 | ) | (27,761 | ) | |||||

| Advertising expense | (21,021 | ) | (21,021 | ) | |||||

| Consultancy expense | (151,547 | ) | (151,547 | ) | |||||

| Depreciation and amortization expense | (452,072 | ) | (452,072 | ) | |||||

| Other expenses | (67,114 | ) | (67,114 | ) | |||||

| Operating loss | (39,739 | ) | (39,739 | ) | |||||

| Financial cost | (15,713 | ) | (15,713 | ) | |||||

| Loss before income tax | (55,452 | ) | (55,452 | ) | |||||

| Income tax expense | – | – | |||||||

| Loss for the period after tax | (55,452 | ) | (55,452 | ) | |||||

| Other comprehensive income | |||||||||

| Items that will be reclassified subsequently to profit and loss | |||||||||

| Exchange differences on translating foreign operations | 22,320 | 22,320 | |||||||

| Total comprehensive loss for the period | (33,132 | ) | (33,132 | ) | |||||

| Earnings per share | |||||||||

| Basic loss per share | (0.04 | ) | (0.04 | ) | |||||

| Diluted loss per share | (0.04 | ) | (0.04 | ) | |||||

| Locafy Limited Consolidated Statement of Financial Position | ||||||||

| As at 30 Sep 2024 AUD $ (unaudited) | As at 30 Jun 2024 AUD $ (audited) | As at 30 Jun 2023 AUD $ (audited) | ||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | 409,379 | 275,875 | 3,174,700 | |||||

| Trade and other receivables | 1,493,217 | 904,564 | 1,288,513 | |||||

| Other assets | 271,900 | 294,355 | 356,782 | |||||

| Total current assets | 2,174,496 | 1,474,794 | 4,819,995 | |||||

| Non-current assets | ||||||||

| Property, plant and equipment | 171,759 | 196,929 | 380,018 | |||||

| Right of use assets | 251,760 | 280,810 | 314,596 | |||||

| Intangible assets | 4,162,493 | 4.204,966 | 3,720,272 | |||||

| Total non-current assets | 4,586,012 | 4,682,705 | 4,414,886 | |||||

| Total assets | 6,760,508 | 6,157,499 | 9,234,881 | |||||

| Liabilities | ||||||||

| Current liabilities | ||||||||

| Trade and other payables | 1,229,033 | 1,252,503 | 2,507,573 | |||||

| Borrowings | 271,600 | 271,600 | 301,600 | |||||

| Provisions | 187,130 | 211,300 | 214,465 | |||||

| Accrued expenses | 380,283 | 496,749 | 512,611 | |||||

| Lease liabilities | 131,162 | 128,669 | 85,165 | |||||

| Contract and other liabilities | 153,192 | 147,640 | 152,211 | |||||

| Total current liabilities | 2,352,400 | 2,508,461 | 3,773,625 | |||||

| Non-current liabilities | ||||||||

| Lease liabilities | 170,183 | 203,909 | 332,578 | |||||

| Provisions | 132,234 | 133,399 | 138,721 | |||||

| Total non-current liabilities | 302,417 | 337,308 | 471,299 | |||||

| Total liabilities | 2,654,817 | 2,845,769 | 4,244,924 | |||||

| Net assets | 4,105,691 | 3,311,730 | 4,989,957 | |||||

| Equity | ||||||||

| Issued capital | 49,366,644 | 48,588,888 | 47,930,486 | |||||

| Reserves | 2,997,336 | 2,925,679 | 2,404,933 | |||||

| Accumulated losses | (48,258,288 | ) | (48,202,837 | ) | (45,345,462 | ) | ||

| Total equity | 4,105,692 | 3,311,730 | 4,989,957 | |||||

| Locafy Limited Consolidated Statement of Cash Flows | |||||||||

| 3 months to 30 Sep 2024 AUD $ (unaudited) | FY2024 | FY2023 | |||||||

| Cash flows from operating activities | |||||||||

| Receipts from customers (inclusive of GST) | 640,786 | 3,098,793 | 4,463,725 | ||||||

| Payments to suppliers and employees (inclusive of GST) | (916,112 | ) | (4,658,997 | ) | (7,005,510 | ) | |||

| R&D Tax Incentive and government grants | – | 561,501 | 386,181 | ||||||

| Financial cost | (15,713 | ) | (114,199 | ) | (105,367 | ) | |||

| Net cash used by operating activities | (291,039 | ) | (1,112,902 | ) | (2,260,971 | ) | |||

| Cash flows from investing activities | |||||||||

| Purchase of intellectual property | (355,381 | ) | (2,166,587 | ) | (1,617,446 | ) | |||

| Purchase of property, plant and equipment | – | – | (2,170 | ) | |||||

| Maturity of term deposit | – | 40,000 | – | ||||||

| Net cash used by investing activities | (355,381 | ) | (2,126,587 | ) | (1,619,616 | ) | |||

| Cash flows from financing activities | |||||||||

| Proceeds from issue of shares | 821,814 | 769,936 | 3,295,822 | ||||||

| Payment for share issue costs | (29,492 | ) | (313,643 | ) | (403,373 | ) | |||

| Repayment of borrowings | – | (30,000 | ) | (6,500 | ) | ||||

| Leasing liabilities | (31,233 | ) | (85,165 | ) | (32,673 | ) | |||

| Net cash from financing activities | 761,089 | 341,128 | 2,853,276 | ||||||

| Net increase/(decrease) in cash and cash equivalents | 114,669 | (2,898,361 | ) | (1,027,311 | ) | ||||

| Net foreign exchange difference | 18,835 | (464 | ) | 118,276 | |||||

| Cash and cash equivalents at the beginning of the period | 275,875 | 3,174,700 | 4,083,735 | ||||||

| Cash and cash equivalents at the end of the period | 409,379 | 275,875 | 3,174,700 | ||||||