– Third Quarter Net Revenue of $94.4 million, up 60% Year-over-Year –

– Net Income was $3.4 million compared to a Net Loss of ($3.6) in prior year –

– Adjusted EBITDA was $16.3 million compared to $1.0 in prior year –

– Raising Full Year 2024 EBITDA Guidance Again on Continued Execution Strength –

– Repurchased $10.1 Million of Common Shares in the Third Quarter –

WHITE PLAINS, N.Y., Nov. 07, 2024 (GLOBE NEWSWIRE) — Turtle Beach Corporation (Nasdaq: HEAR), a leading gaming accessories brand, today reported financial results for the third quarter ended September 30, 2024.

Third Quarter Highlights

- Net revenue was $94.4 million, an increase of 60% compared to the prior year period.

- Net income was $3.4 million or $0.16 per diluted share compared to a net loss of $(3.6) million or $(0.21) net loss per diluted share in the prior year period.

- Adjusted EBITDA was $16.3 million, an improvement of $15.2 million compared to an Adjusted EBITDA of $1.0 million in the prior year period.

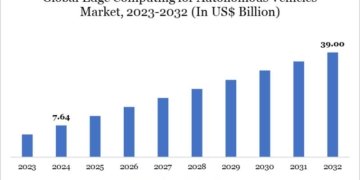

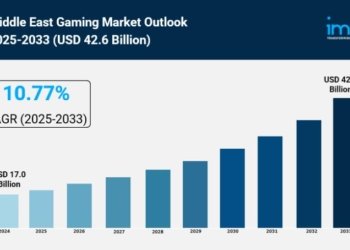

“We delivered another strong quarter of performance, showcasing the continued momentum in our business, and have made tremendous progress towards the integration of PDP following our transformative acquisition earlier this year. Our third quarter revenue grew 60% year-over-year to $94.4 million, while adjusted EBITDA increased significantly to $16.3 million, reflecting the benefits of our expanded portfolio and operational improvements. Excluding PDP’s contributions, our organic revenue grew approximately 15% compared to last year, highlighting the depth of our underlying business and an unwavering focus on execution. The gaming accessories market continues to show robust growth year-to-date, particularly in our core categories. We believe there are still additional synergies to be realized as we continue to optimize our operations,” said Cris Keirn, CEO, Turtle Beach Corporation.

“Our market position continues to strengthen, with notable share gains across key categories. The integration of PDP is exceeding our expectations, and we now anticipate achieving total annual synergies exceeding $13 million, surpassing our initial estimates. Our gross margin expansion of 630 basis points year-over-year to 36.2% demonstrates the success of our cost optimization initiatives and reduced promotional spending.”

“We’re excited about our upcoming product pipeline and the continued benefits from our increased scale and diversification. Our visibility regarding continued strong demand for our products ahead of the holiday season and our improved financial performance is reflected in our increased Adjusted EBITDA guidance for the year, as we detail below. We remain focused on driving innovation, operational excellence, and market leadership while delivering value to our shareholders and gaming customers worldwide.

“Further, our confidence in Turtle Beach’s value creation over the long-term is reflected in our share repurchase program, through which we bought back $10.1 million of stock in the third quarter alone. This repurchase came in addition to the more than $15 million of shares that we repurchased in the second quarter. Combined, the past two quarters mark the largest share repurchase in the history of Turtle Beach, punctuating our continued commitment to return capital to shareholders in conjunction with investing appropriately in the Company. We believe these repurchases represent a strategic investment that underscore our confidence in the Company’s future, based on our assessment of the intrinsic value of the shares.”

Share Repurchase Update

During the third quarter ended September 30, 2024, the Company repurchased approximately 688,000 shares of common stock for an aggregate purchase price of $10.1 million. The Company has repurchased $25.3 million year-to-date, and has $21.3 million remaining to repurchase shares under its share repurchase program which expires on April 9, 2025.

Balance Sheet and Cash Flow Summary

At September 30, 2024, the Company had net debt of $94.1 million, comprised of $107.9 million of borrowings less $13.8 million of cash. Inventories at September 30, 2024 were $102.3 million compared to $44.0 million at December 31, 2023 which now includes PDP. Cash flow used in operations for the nine months ended September 30, 2024 was $8.6 million compared to cash from operations of $7.9 million for the nine months ended September 30, 2023.

Given the required investment in inventory that the Company undertakes ahead of the holiday season, it is typical that the Company’s net debt temporarily increases at the end of the third quarter of each year due to these working capital requirements.

Outlook

Turtle Beach is updating its 2024 outlook. The Company is maintaining its guidance for net revenue for the full year ending December 31, 2024, to be between $370 and $380 million. This revenue range translates to 43-47% growth year-over-year.

The Company currently expects Adjusted EBITDA for the full year ending December 31, 2024, to be between $55 and $58 million, up from the prior range of between $53 million to $56 million compared to $6.5 million of Adjusted EBITDA for 2023.

Earnings Conference Call and Webcast Details

Turtle Beach will host a conference call and audio webcast today, November 7, 2024, at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time), during which management will discuss third quarter results and provide commentary on business performance and its current outlook for 2024. A question-and-answer session will follow the prepared remarks.

The conference call may be accessed by telephone by dialing 800-717-1738 (domestic) or 646-307-1865 (international).

A live audio webcast of the earnings conference call may be accessed on Turtle Beach’s website at http://www.corp.turtlebeach.com, along with a copy of this press release and an investor slide presentation. An audio replay of the call will be available on the Company’s investor relations website for a limited period of time.

About Turtle Beach Corporation

Turtle Beach Corporation (the “Company”) (http://www.turtlebeachcorp.com) is one of the world’s leading gaming accessory providers. The Company’s namesake Turtle Beach brand (http://www.turtlebeach.com) is known for designing best-selling gaming headsets, top-rated game controllers, award-winning PC gaming peripherals, and groundbreaking gaming simulation accessories. Innovation, first-to-market features, a broad range of products for all types of gamers, and top-rated customer support have made Turtle Beach a fan-favorite brand and the market leader in console gaming audio for over a decade. Turtle Beach Corporation acquired Performance Designed Products LLC (http://www.pdp.com) in 2024. Turtle Beach’s shares are traded on the Nasdaq Exchange under the symbol: HEAR.

Non-GAAP Financial Measures

In addition to its reported results, the Company has included in this earnings release certain financial metrics, including Adjusted EBITDA, that the Securities and Exchange Commission define as “non-GAAP financial measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period-to-period comparisons of the Company’s results. Non-GAAP financial measures are not an alternative to the Company’s GAAP financial results and may not be calculated in the same manner as similar measures presented by other companies. “Adjusted EBITDA” is defined by the Company as net income (loss) before interest, taxes, depreciation and amortization, stock-based compensation (non-cash), and certain non-recurring special items that we believe are not representative of core operations, as further described in Table 4. These non-GAAP financial measures are presented because management uses non-GAAP financial measures to evaluate the Company’s operating performance, to perform financial planning, and to determine incentive compensation. Therefore, the Company believes that the presentation of non-GAAP financial measures provides useful supplementary information to, and facilitates additional analysis by, investors. The non-GAAP financial measures included herein exclude items that management does not believe reflect the Company’s core operating performance because such items are inherently unusual, non-operating, unpredictable, non-recurring, or non-cash. See a reconciliation of GAAP results to Adjusted EBITDA included as Table 4 below for each of the three and nine months ended September 30, 2023 and September 30, 2024.

By providing full year 2024 Adjusted EBITDA guidance, the Company provided its expectation of a forward-looking non-GAAP financial measure. Information reconciling full year 2024 Adjusted EBITDA to its most directly comparable GAAP financial measure, net income (loss), is unavailable to the Company without unreasonable effort due to the variability, complexity, and lack of visibility with respect to certain reconciling items between Adjusted EBITDA and net income (loss), including other income (expense), provision for income taxes and stock-based compensation. These items cannot be reasonably and accurately predicted without the investment of undue time, cost and other resources and, accordingly, a reconciliation of the Company’s Adjusted EBITDA outlook to its net income (loss) outlook for such periods is not provided. These reconciling items could be material to the Company’s actual results for such periods.

Cautionary Note on Forward-Looking Statements

This press release includes forward-looking information and statements within the meaning of the federal securities laws. Except for historical information contained in this release, statements in this release may constitute forward-looking statements regarding assumptions, projections, expectations, targets, intentions, or beliefs about future events. Statements containing the words “may”, “could”, “would”, “should”, “believe”, “expect”, “anticipate”, “plan”, “estimate”, “target”, “goal”, “project”, “intend” and similar expressions, or the negatives thereof, constitute forward-looking statements. Forward-looking statements are only predictions and are not guarantees of performance. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. The inclusion of such information should not be regarded as a representation by the Company, or any person, that the objectives of the Company will be achieved. Forward-looking statements are based on management’s current beliefs and expectations, as well as assumptions made by, and information currently available to, management.

While the Company believes that its expectations are based upon reasonable assumptions, there can be no assurances that its goals and strategy will be realized. Numerous factors, including risks and uncertainties, may affect actual results and may cause results to differ materially from those expressed in forward-looking statements made by the Company or on its behalf. Some of these factors include, but are not limited to, risks related to logistic and supply chain challenges and costs, the substantial uncertainties inherent in the acceptance of existing and future products, the difficulty of commercializing and protecting new technology, the impact of competitive products and pricing, general business and economic conditions, risks associated with the expansion of our business including the integration of any businesses we acquire and the integration of such businesses within our internal control over financial reporting and operations, our indebtedness, liquidity, and other factors discussed in our public filings, including the risk factors included in the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, and the Company’s other periodic reports filed with the Securities and Exchange Commission. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission, the Company is under no obligation to publicly update or revise any forward-looking statement after the date of this release whether as a result of new information, future developments or otherwise.

CONTACTS

Investors:

hear@icrinc.com

(646) 277-1285

Public Relations & Media:

MacLean Marshall

Sr. Director, Global Communications

Turtle Beach Corporation

(858) 914-5093

maclean.marshall@turtlebeach.com

| Turtle Beach Corporation Condensed Consolidated Statements of Operations (in thousands, except per-share data) (unaudited) | ||||||||||||||||||||

| Table 1. | ||||||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| September 30, | September 30, | September 30, | September 30, | |||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||||||

| Net revenue | $ | 94,363 | $ | 59,158 | $ | 226,689 | $ | 158,584 | ||||||||||||

| Cost of revenue | 60,232 | 41,469 | 151,696 | 114,884 | ||||||||||||||||

| Gross profit | 34,131 | 17,689 | 74,993 | 43,700 | ||||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Selling and marketing | 13,535 | 10,583 | 36,289 | 30,457 | ||||||||||||||||

| Research and development | 4,311 | 4,380 | 12,802 | 12,670 | ||||||||||||||||

| General and administrative | 6,352 | 5,243 | 19,489 | 25,375 | ||||||||||||||||

| Acquisition-related cost | 3,510 | – | 9,814 | – | ||||||||||||||||

| Total operating expenses | 27,708 | 20,206 | 78,394 | 68,502 | ||||||||||||||||

| Operating income (loss) | 6,423 | (2,517 | ) | (3,401 | ) | (24,802 | ) | |||||||||||||

| Interest expense | 2,712 | 107 | 5,082 | 253 | ||||||||||||||||

| Other non-operating expense, net | 252 | 481 | 974 | 799 | ||||||||||||||||

| Income (loss) before income tax | 3,459 | (3,105 | ) | (9,457 | ) | (25,854 | ) | |||||||||||||

| Income tax expense (benefit) | 46 | 501 | (5,501 | ) | 377 | |||||||||||||||

| Net income (loss) | $ | 3,413 | $ | (3,606 | ) | $ | (3,956 | ) | $ | (26,231 | ) | |||||||||

| Net income (loss) per share | ||||||||||||||||||||

| Basic | $ | 0.17 | $ | (0.21 | ) | $ | (0.20 | ) | $ | (1.54 | ) | |||||||||

| Diluted | $ | 0.16 | $ | (0.21 | ) | $ | (0.20 | ) | $ | (1.54 | ) | |||||||||

| Weighted average number of shares: | ||||||||||||||||||||

| Basic | 20,553 | 17,345 | 20,050 | 17,029 | ||||||||||||||||

| Diluted | 21,501 | 17,345 | 20,050 | 17,029 | ||||||||||||||||

| Turtle Beach Corporation Condensed Consolidated Balance Sheets (in thousands, except par value and share amounts) | ||||||||||

| Table 2. | ||||||||||

| September 30, | December 31, | |||||||||

| 2024 | 2023 | |||||||||

| (unaudited) | ||||||||||

| ASSETS | ||||||||||

| Current Assets: | ||||||||||

| Cash and cash equivalents | $ | 13,803 | $ | 18,726 | ||||||

| Accounts receivable, net | 70,703 | 54,390 | ||||||||

| Inventories | 102,263 | 44,019 | ||||||||

| Prepaid expenses and other current assets | 9,686 | 7,720 | ||||||||

| Total Current Assets | 196,455 | 124,855 | ||||||||

| Property and equipment, net | 5,753 | 4,824 | ||||||||

| Goodwill | 56,700 | 10,686 | ||||||||

| Intangible assets, net | 44,544 | 1,734 | ||||||||

| Other assets | 9,749 | 7,868 | ||||||||

| Total Assets | $ | 313,201 | $ | 149,967 | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||

| Current Liabilities: | ||||||||||

| Revolving credit facility | $ | 58,626 | $ | — | ||||||

| Accounts payable | 66,394 | 26,908 | ||||||||

| Other current liabilities | 30,689 | 29,424 | ||||||||

| Total Current Liabilities | 155,709 | 56,332 | ||||||||

| Debt, non-current | 45,696 | — | ||||||||

| Income tax payable | 1,489 | 1,546 | ||||||||

| Other liabilities | 8,488 | 7,012 | ||||||||

| Total Liabilities | 211,382 | 64,890 | ||||||||

| Commitments and Contingencies | ||||||||||

| Stockholders’ Equity | ||||||||||

| Common stock | 20 | 18 | ||||||||

| Additional paid-in capital | 239,345 | 220,185 | ||||||||

| Accumulated deficit | (138,233 | ) | (134,277 | ) | ||||||

| Accumulated other comprehensive loss | 687 | (849 | ) | |||||||

| Total Stockholders’ Equity | 101,819 | 85,077 | ||||||||

| Total Liabilities and Stockholders’ Equity | $ | 313,201 | $ | 149,967 | ||||||

| Turtle Beach Corporation Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) | ||||||||

| Table 3. | ||||||||

| Nine Months Ended | ||||||||

| September 30, 2024 | September 30, 2023 | |||||||

| (in thousands) | ||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (3,956 | ) | $ | (26,231 | ) | ||

| Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: | ||||||||

| Depreciation and amortization | 3,261 | 2,912 | ||||||

| Costs recognized on sale of acquired inventory | 2,085 | — | ||||||

| Amortization of intangible assets | 4,843 | 761 | ||||||

| Amortization of debt financing costs | 625 | 108 | ||||||

| Stock-based compensation | 3,447 | 8,554 | ||||||

| Deferred income taxes | (6,739 | ) | (178 | ) | ||||

| Change in sales returns reserve | 1,369 | (2,473 | ) | |||||

| Provision for obsolete inventory | 4,690 | 200 | ||||||

| Loss on impairment of asset | 753 | — | ||||||

| Changes in operating assets and liabilities, net of acquisitions: | ||||||||

| Accounts receivable | 4,344 | 12,563 | ||||||

| Inventories | (43,597 | ) | (4,986 | ) | ||||

| Accounts payable | 30,050 | 19,072 | ||||||

| Prepaid expenses and other assets | 127 | 385 | ||||||

| Income taxes payable | 485 | 126 | ||||||

| Other liabilities | (10,340 | ) | (2,869 | ) | ||||

| Net cash provided (used for) by operating activities | (8,553 | ) | 7,944 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Purchases of property and equipment | (3,392 | ) | (1,924 | ) | ||||

| Acquisition of a business, net of cash acquired | (77,294 | ) | — | |||||

| Net cash used for investing activities | (80,686 | ) | (1,924 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Borrowings on revolving credit facilities | 242,609 | 149,995 | ||||||

| Repayment of revolving credit facilities | (183,983 | ) | (155,787 | ) | ||||

| Proceeds of term loan | 50,000 | — | ||||||

| Repayment of term loan | (729 | ) | — | |||||

| Proceeds from exercise of stock options and warrants | 3,004 | 1,718 | ||||||

| Repurchase of common stock | (25,339 | ) | (974 | ) | ||||

| Debt issuance costs | (2,897 | ) | (80 | ) | ||||

| Net cash provided by (used for) financing activities | 82,665 | (5,128 | ) | |||||

| Effect of exchange rate changes on cash and cash equivalents | 1,651 | 52 | ||||||

| Net increase (decrease) in cash and cash equivalents | (4,923 | ) | 944 | |||||

| Cash and cash equivalents – beginning of period | 18,726 | 11,396 | ||||||

| Cash and cash equivalents – end of period | $ | 13,803 | $ | 12,340 | ||||

| Turtle Beach Corporation GAAP to Adjusted EBITDA Reconciliation (in thousands) | ||||||||||||||||

| Table 4. | ||||||||||||||||

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Net loss | $ | 3,413 | $ | (3,606 | ) | $ | (3,956 | ) | $ | (26,231 | ) | |||||

| Interest expense | 2,712 | 107 | 5,082 | 253 | ||||||||||||

| Depreciation and amortization | 3,322 | 1,212 | 8,104 | 3,673 | ||||||||||||

| Stock-based compensation | 1,496 | 1,625 | 3,447 | 8,554 | ||||||||||||

| Income tax benefit (1) | 46 | 501 | (5,501 | ) | 377 | |||||||||||

| Restructuring expense (2) | 910 | 1,104 | 1,657 | 1,104 | ||||||||||||

| CEO transition related costs (3) | — | — | — | 2,874 | ||||||||||||

| Business transaction expense (4) | 3,510 | — | 9,814 | — | ||||||||||||

| Incremental costs on acquired inventory (5) | 833 | — | 2,084 | — | ||||||||||||

| Proxy contest and other (6) | 26 | 94 | 30 | 1,936 | ||||||||||||

| Adjusted EBITDA | $ | 16,268 | $ | 1,037 | $ | 20,761 | $ | (7,460 | ) | |||||||

(1) An income tax benefit of $7.0 million was recorded in the three months ended March 31, 2024 as a result of the reversal of a portion of the Company’s deferred tax asset valuation allowance.

(2) Restructuring charges are expenses that are paid in connection with reorganization of our operations. These costs primarily include severance and related benefits.

(3) CEO transition related expense includes one-time costs associated with the separation of its former CEO. Such costs included severance, bonus, medical benefits and the tax impact of accelerated vesting of stock-based compensation.

(4) Business transaction expense includes one-time costs we incurred in connection with acquisitions including warehouse lease impairment, professional fees such as legal and accounting along with other certain integration related costs.

(5) Costs relate to the step up of acquired PDP finished goods inventory to fair market value as required under GAAP purchase accounting. This step up in value over original cost is recorded as a charge to cost of revenue as such inventory is sold.

(6) Proxy contest and other primarily includes one-time legal and other professional fees associated with proxy challenges presented by certain shareholder activists.