𝐒𝐚𝐮𝐝𝐢 𝐀𝐫𝐚𝐛𝐢𝐚 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

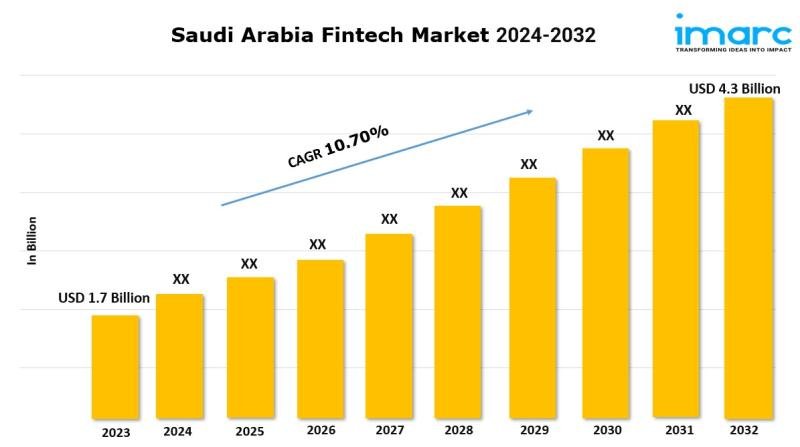

𝐁𝐚𝐬𝐞 𝐘𝐞𝐚𝐫: 2023

𝐇𝐢𝐬𝐭𝐨𝐫𝐢𝐜𝐚𝐥 𝐘𝐞𝐚𝐫𝐬: 2018-2023

𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐘𝐞𝐚𝐫𝐬: 2024-2032

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐢𝐳𝐞 𝐢𝐧 𝟐𝟎𝟐𝟑: 𝐔𝐒𝐃 𝟏.𝟕 𝐁𝐢𝐥𝐥𝐢𝐨𝐧

𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐢𝐧 𝟐𝟎𝟑𝟐: 𝐔𝐒𝐃 𝟒.𝟑 𝐁𝐢𝐥𝐥𝐢𝐨𝐧

𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡 𝐑𝐚𝐭𝐞: 𝟏𝟎.𝟕𝟎% (2024-2032)

The Saudi Arabia fintech market size reached 𝐔𝐒𝐃 𝟏.𝟕 𝐁𝐢𝐥𝐥𝐢𝐨𝐧 in 2023. Looking forward, IMARC Group expects the market to reach 𝐔𝐒𝐃 𝟒.𝟑 𝐁𝐢𝐥𝐥𝐢𝐨𝐧 by 2032, exhibiting a 𝐠𝐫𝐨𝐰𝐭𝐡 𝐫𝐚𝐭𝐞 (𝐂𝐀𝐆𝐑) 𝐨𝐟 𝟏𝟎.𝟕𝟎% during 2024-2032.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐟𝐨𝐫 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/saudi-arabia-fintech-market/requestsample

𝐒𝐚𝐮𝐝𝐢 𝐀𝐫𝐚𝐛𝐢𝐚 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐞𝐧𝐝𝐬 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞𝐫𝐬:

The financial technology sector in Saudi Arabia is undergoing a remarkable transformation, propelled by a significant push towards digitalization across various industries. One of the primary catalysts for this expansion is the widespread adoption of digital technologies that streamline and enhance financial services. Fintech, or financial technology, integrates innovative technological solutions to improve and automate the delivery of financial services.

This sector encompasses a range of applications from mobile banking and online payment platforms to emerging arenas like cryptocurrency and peer-to-peer lending. The adoption of these technologies facilitates more efficient transaction processes, offers personalized financial advice through data analytics, and broadens financial inclusion by reaching underserved communities. These advancements are fostering a new wave of convenience while driving the cost of financial transactions down, making it an attractive alternative to traditional banking methods.

Moreover, the growth of the fintech market in Saudi Arabia is heavily supported by the evolving regulatory landscape that favors innovation and competition in the financial sector. The Saudi government and financial regulators are laying down frameworks that promote fintech development while ensuring robust data security and consumer protection. These regulatory adjustments are removing historical barriers to entry, allowing both startups and established tech firms to innovate and compete on a level playing field. The shift towards a regulatory environment that both encourages innovation and maintains stringent oversight is crucial in building a resilient and dynamic fintech ecosystem.

The fintech sector’s growth is further fueled by changing consumer behaviors and technological advancements. In Saudi Arabia, the penetration rate of smartphones and the internet is high, setting a fertile ground for digital financial solutions. Consumers are increasingly demanding seamless and instantaneous financial services, and fintech companies are responding by developing user-friendly platforms that integrate instant payment systems, automated savings tools, and sophisticated financial management apps. This shift is indicative of a broader trend where modern consumers expect digital services to be integrated into their daily lives, influencing how they manage, invest, and transact financially.

In addition to consumer preferences, technological advancements play a pivotal role in the fintech sector’s growth. With the rise of artificial intelligence (AI) and machine learning, fintech firms are able to enhance their services with superior risk assessment capabilities, more effective fraud detection systems, and personalized financial recommendations tailored to individual user profiles. These technological innovations are not just improving the quality and security of financial services but are also setting new standards for the industry, compelling traditional financial institutions to innovate. As these technologies continue to evolve, they are expected to drive further growth in the fintech sector by enabling more sophisticated, secure, and customer-focused financial solutions.

𝐕𝐢𝐞𝐰 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐰𝐢𝐭𝐡 𝐓𝐎𝐂 & 𝐋𝐢𝐬𝐭 𝐨𝐟 𝐅𝐢𝐠𝐮𝐫𝐞: https://www.imarcgroup.com/saudi-arabia-fintech-market

𝐒𝐚𝐮𝐝𝐢 𝐀𝐫𝐚𝐛𝐢𝐚 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧:

𝐒𝐞𝐫𝐯𝐢𝐜𝐞 𝐏𝐫𝐨𝐩𝐨𝐬𝐢𝐭𝐢𝐨𝐧 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬:

• Money Transfer and Payments

• Savings and Investments

• Digital Lending and Lending Marketplaces

• Online Insurance and Insurance Marketplaces

• Others

𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬:

• Northern and Central Region

• Western Region

• Eastern Region

• Southern Region

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐋𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

𝐀𝐬𝐤 𝐚𝐧 𝐀𝐧𝐚𝐥𝐲𝐬𝐭: https://www.imarcgroup.com/request?type=report&id=13887&flag=C

𝐊𝐞𝐲 𝐡𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:

• 𝐌𝐚𝐫𝐤𝐞𝐭 𝐏𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 (𝟐𝟎𝟏𝟖-𝟐𝟎𝟐𝟑)

• 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐮𝐭𝐥𝐨𝐨𝐤 (𝟐𝟎𝟐𝟒-𝟐𝟎𝟑𝟐)

• COVID-19 Impact on the Market

• Porter’s Five Forces Analysis

• Strategic Recommendations

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

𝐍𝐨𝐭𝐞: 𝐈𝐟 𝐲𝐨𝐮 𝐧𝐞𝐞𝐝 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐭𝐡𝐚𝐭 𝐢𝐬 𝐧𝐨𝐭 𝐜𝐮𝐫𝐫𝐞𝐧𝐭𝐥𝐲 𝐰𝐢𝐭𝐡𝐢𝐧 𝐭𝐡𝐞 𝐬𝐜𝐨𝐩𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭, 𝐰𝐞 𝐜𝐚𝐧 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐢𝐭 𝐭𝐨 𝐲𝐨𝐮 𝐚𝐬 𝐚 𝐩𝐚𝐫𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐌𝐨𝐫𝐞 𝐋𝐚𝐭𝐞𝐬𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

• 𝐒𝐚𝐮𝐝𝐢 𝐀𝐫𝐚𝐛𝐢𝐚 𝐆𝐚𝐦𝐢𝐧𝐠 𝐂𝐨𝐧𝐬𝐨𝐥𝐞 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.imarcgroup.com/saudi-arabia-gaming-console-market

• 𝐒𝐚𝐮𝐝𝐢 𝐀𝐫𝐚𝐛𝐢𝐚 𝐔𝐬𝐞𝐝 𝐂𝐚𝐫 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.imarcgroup.com/saudi-arabia-used-car-market

• 𝐒𝐚𝐮𝐝𝐢 𝐀𝐫𝐚𝐛𝐢𝐚 𝐑𝐞𝐟𝐢𝐧𝐞𝐝 𝐏𝐞𝐭𝐫𝐨𝐥𝐞𝐮𝐦 𝐏𝐫𝐨𝐝𝐮𝐜𝐭𝐬 𝐌𝐚𝐫𝐤𝐞𝐭: https://www.imarcgroup.com/saudi-arabia-refined-petroleum-products-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐔𝐬:

𝐈𝐌𝐀𝐑𝐂 𝐆𝐫𝐨𝐮𝐩

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.