According to a new study by DataHorizzon Research, the CAE simulation software market is projected to grow at a CAGR of 9.8% from 2025 to 2033. This robust expansion is being driven by the accelerating adoption of digital twin technology, rising complexity in product engineering workflows, and the growing imperative to reduce physical prototyping costs across capital-intensive industries. The CAE simulation software market sits at the convergence of advanced computational modeling, artificial intelligence, and industrial design – making it a strategic priority for aerospace, automotive, defense, and energy sector enterprises globally. As simulation-driven product development becomes standard practice rather than a competitive differentiator, the CAE simulation software market is transitioning from a specialist toolset to a core engineering infrastructure investment. Market size projections confirm sustained double-digit growth well into the next decade, underscoring the long-term strategic relevance of this industry.

CAE Simulation Software Market Key Growth Drivers and Demand Factors

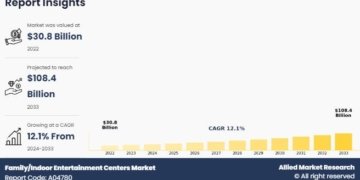

The global CAE simulation software market was valued at USD 8.4 billion in 2024 and is projected to reach USD 21.6 billion by 2033, growing at a CAGR of 9.8% during the forecast period (2025-2033).

The CAE simulation software market is being propelled by a powerful set of technological and industrial forces that are collectively reshaping how products are designed, tested, and brought to market. The single most impactful driver is the integration of artificial intelligence and machine learning into simulation workflows – enabling faster solver performance, automated mesh generation, and predictive failure analysis at a level of accuracy previously unachievable through traditional finite element analysis alone.

Demand shifts are equally significant. Automotive manufacturers accelerating electric vehicle platform development require intensive multi-physics simulation capabilities for battery thermal management, structural crashworthiness, and electromagnetic interference modeling – all core competencies of the CAE simulation software market. Aerospace and defense procurement cycles are increasingly mandating model-based systems engineering frameworks that are deeply simulation-dependent.

Investment trends are reinforcing this trajectory. Cloud-based simulation platforms are attracting substantial venture and private equity funding, democratizing access to high-performance computing resources for mid-sized engineering firms. LSI-aligned demand indicators – including finite element analysis software, computational fluid dynamics tools, structural simulation platforms, and multibody dynamics modeling – are all registering consistent procurement growth. The CAE simulation software market growth analysis further reflects strong momentum in digital twin adoption, where simulation software serves as the computational backbone for real-time asset performance modeling across manufacturing and energy infrastructure sectors.

Get a free sample report: https://datahorizzonresearch.com/request-sample-pdf/cae-simulation-software-market-46800

Why Choose Our CAE Simulation Software Market Research Report

Our research report on the CAE simulation software market is designed for engineering leaders, technology investors, and strategic planners who demand analytical rigor over surface-level market summaries. The report draws on primary research engagements with simulation software developers, CAE integration specialists, enterprise procurement teams, and academic R&D institutions – producing a market intelligence product grounded in real engineering and commercial realities.

The competitive landscape section delivers deep-profile analysis of both established vendors and emerging challengers reshaping the CAE simulation software market through cloud-native architectures, AI-augmented solvers, and vertical-specific simulation suites. Revenue forecasting is built on segmented demand modeling that accounts for software licensing evolution, transition to SaaS deployment models, and industry-specific adoption velocity.

Segmentation spans simulation type, deployment architecture, end-user industry, company size, and regional performance – equipping buyers of this report with the granular intelligence needed to evaluate partnership opportunities, assess competitive positioning, and identify high-margin product niches within the CAE simulation software market. For investors, technology vendors, and enterprise procurement decision-makers alike, this report represents the most decision-ready intelligence available in the market forecast landscape.

Top Reasons to Invest in the CAE Simulation Software Market Report

• Precision entry timing: The CAE simulation software market is entering a high-velocity growth phase driven by AI integration and cloud migration – this report provides the intelligence needed to position ahead of that inflection point with confidence.

• Software monetization benchmarking: Understand how leading vendors in the CAE simulation software market are structuring licensing models, subscription tiers, and enterprise contract frameworks to maximize recurring revenue and customer retention.

• Vertical opportunity mapping: Identify which end-user industries – automotive, aerospace, energy, healthcare devices, or consumer electronics – are generating the highest simulation software spend and the fastest adoption growth.

• Technology investment prioritization: Evaluate where AI-driven simulation, cloud HPC infrastructure, and digital twin integration are creating durable competitive advantages within the CAE simulation software market competitive landscape.

• Acquisition and partnership targeting: Use vendor profiling and market share data to identify strategic M&A targets, white-label partnership candidates, and technology licensing opportunities across the CAE simulation software market ecosystem.

• Regulatory and standards compliance readiness: Understand how industry certification requirements – particularly in aerospace, medical devices, and automotive safety – are influencing simulation software procurement decisions and creating compliance-driven demand within the CAE simulation software market.

CAE Simulation Software Market Challenges, Risks, and Barriers

Despite compelling growth fundamentals, the CAE simulation software market faces substantive barriers. High software licensing costs and the computational infrastructure investment required for complex simulations remain significant adoption constraints for small and medium engineering firms. Talent scarcity in simulation engineering – particularly professionals fluent in both physical modeling and advanced numerical methods – limits enterprise deployment speed. Interoperability challenges between legacy CAD platforms and modern simulation environments create integration friction. Export control regulations affecting high-fidelity defense simulation tools add compliance complexity in international markets. Additionally, the rapid pace of AI-driven product evolution risks fragmenting the competitive landscape in ways that create vendor selection uncertainty for risk-averse enterprise buyers.

Top 10 Companies in the CAE Simulation Software Market

• Ansys Inc.

• Dassault Systèmes SE

• Siemens Digital Industries Software

• Altair Engineering Inc.

• MSC Software Corporation (Hexagon)

• PTC Inc.

• Autodesk Inc.

• ESI Group

• COMSOL AB

• Cadence Design Systems Inc.

Market Segmentation

By Type

o Finite Element Analysis (Structural Analysis, Thermal Analysis, Electromagnetic Analysis)

o Computational Fluid Dynamics (Flow Analysis, Heat Transfer, Mass Transfer)

o Multibody Dynamics (Kinematics, Dynamic Analysis, Impact Analysis)

By End-User

o Automotive (Vehicle Design, Crash Testing, Aerodynamics)

o Aerospace & Defense (Aircraft Design, Space Systems, Defense Applications)

o Healthcare (Medical Device Design, Biomechanics, Drug Delivery)

o Industrial Equipment (Machine Design, Process Optimization, Plant Layout)

o Electronics (Component Design, Thermal Management, EMC Analysis)

By Deployment

o Cloud-Based Solutions (SaaS, PaaS)

o On-Premise Systems

By Organization Size

o Large Enterprises

o Small and Medium-sized Enterprises (SMEs)

By Industry Vertical

o Manufacturing

o Energy & Power

o Construction

o Others

By Region

o North America

o Europe

o Latin America

o Asia Pacific

o Middle East and Africa

Recent Developments in the CAE Simulation Software Market

• In early 2025, a leading CAE simulation software market vendor launched a cloud-native, AI-accelerated solver platform specifically optimized for electric vehicle battery pack thermal simulation, reducing computation time by over 60% compared to conventional finite element methods.

• A major European aerospace manufacturer formalized a multi-year enterprise agreement with a top-tier simulation software provider to standardize model-based systems engineering workflows across all product development divisions, significantly expanding that vendor’s CAE simulation software market footprint.

• A prominent simulation software developer completed the acquisition of an AI-driven topology optimization startup in late 2024, integrating generative design capabilities directly into its flagship CAE simulation software market product suite.

• Two established players in the CAE simulation software market announced a technology partnership to develop a unified multiphysics simulation environment capable of seamlessly bridging structural, thermal, and electromagnetic analysis within a single cloud-hosted workflow.

• A Series B funding round of USD 78 million was secured by an emerging cloud-native simulation platform targeting mid-market engineering firms previously priced out of enterprise CAE simulation software market solutions.

• Several vendors within the CAE simulation software market expanded their Asia-Pacific regional operations in 2024-2025, opening dedicated engineering support centers in India, South Korea, and Japan to serve rapidly growing automotive and semiconductor manufacturing clients.

CAE Simulation Software Market Regional Performance & Geographic Expansion

North America commands the largest share of the CAE simulation software market, anchored by the United States’ dense concentration of aerospace, defense, and automotive engineering enterprises with deep simulation investment mandates. Europe follows closely, with Germany, France, and the United Kingdom driving demand through advanced manufacturing sectors and stringent product certification standards. Asia-Pacific is the fastest-growing regional segment – China, Japan, South Korea, and India are each investing heavily in domestic simulation capability as part of broader industrial self-sufficiency strategies. Latin America is registering nascent but accelerating traction, primarily within Brazil’s automotive and energy sectors. The Middle East & Africa region is emerging as a meaningful growth contributor, particularly through defense modernization programs and upstream energy infrastructure projects in the UAE and Saudi Arabia.

How CAE Simulation Software Market Insights Drive ROI Growth

Organizations that embed structured intelligence from the CAE simulation software market into their strategic planning processes gain measurable advantages across the product development and investment lifecycle. Precise segmentation data enables software vendors to align product roadmaps with the highest-demand simulation categories – reducing R&D spend misallocation and accelerating feature monetization. Competitive benchmarking drawn from the CAE simulation software market forecast reveals white space opportunities where underserved verticals or deployment models present uncontested revenue potential. Forecast leverage – using scenario-based projections tied to AI adoption rates and cloud migration timelines – allows leadership teams to sequence investment decisions with higher confidence. Enterprise buyers using CAE simulation software market intelligence to inform procurement strategies consistently report better contract outcomes, more favorable vendor negotiations, and stronger internal justification for technology budget expansion.

Sustainability & Regulatory Outlook

Sustainability is rapidly becoming a structural demand driver within the CAE simulation software market. As manufacturers across automotive, aerospace, and energy sectors face mounting pressure to reduce carbon emissions and material waste, simulation software is being repositioned as a direct sustainability enabler – allowing engineers to optimize material usage, minimize failed prototype cycles, and model energy efficiency improvements before committing to physical production. The environmental ROI of simulation-driven design is increasingly being quantified and reported within corporate ESG disclosures, raising the visibility of the CAE simulation software market within boardroom sustainability conversations.

From a regulatory standpoint, the CAE simulation software market operates within a complex and tightening compliance environment. The European Union’s product safety regulation updates, aerospace certification frameworks such as DO-178C and AS9100, and automotive functional safety standards like ISO 26262 are all generating non-discretionary demand for validated simulation workflows. Export control legislation – particularly U.S. Export Administration Regulations governing high-performance simulation tools with dual-use potential – continues to shape vendor go-to-market strategies in sensitive international markets.

The convergence of sustainability mandates and regulatory compliance requirements is creating a durable, policy-reinforced growth foundation for the CAE simulation software market – one that is structurally independent of cyclical engineering budgets and likely to intensify as both environmental accountability and product certification rigor increase globally through the forecast period.

Key Questions Answered in the Report

1. What is the projected revenue forecast for the CAE simulation software market through 2033, and how do AI integration and cloud adoption affect growth scenarios?

2. Which region will dominate the CAE simulation software market, and what industry-specific factors underpin that regional leadership position?

3. What are the highest-margin software segments and deployment models within the CAE simulation software market, and how are monetization structures evolving?

4. Who are the emerging challengers gaining traction in the CAE simulation software market, and what technology or business model innovations are fueling their competitive rise?

5. How are sustainability imperatives and industry certification regulations reshaping simulation software procurement priorities within the CAE simulation software market?

6. What M&A and partnership activity is most likely to consolidate or disrupt the CAE simulation software market competitive landscape over the next five years?

Contact:

Ajay N

Ph: +1-970-633-3460

Latest Reports:

Chewing Gum Tester Market: https://datahorizzonresearch.com/chewing-gum-tester-market-22016

Battery Management System Market: https://datahorizzonresearch.com/battery-management-system-market-22692

Ultra Wideband (UWB) Module Market: https://datahorizzonresearch.com/ultra-wideband-uwb-module-market-23368

Smart Wireless Speaker Battery Market: https://datahorizzonresearch.com/smart-wireless-speaker-battery-market-24044

Company Name: DataHorizzon Research

Address: North Mason Street, Fort Collins,

Colorado, United States.

Mail: sales@datahorizzonresearch.com

DataHorizzon is a market research and advisory company that assists organizations across the globe in formulating growth strategies for changing business dynamics. Its offerings include consulting services across enterprises and business insights to make actionable decisions. DHR’s comprehensive research methodology for predicting long-term and sustainable trends in the market facilitates complex decisions for organizations.

This release was published on openPR.