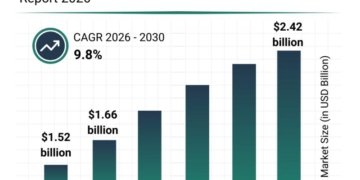

According to a new study by DataHorizzon Research, the business card holder market is projected to grow at a CAGR of 7.1% from 2025 to 2033, driven by resurgent in-person networking activities following remote work normalization, expanding professional services sectors globally, and increasing demand for premium branded accessories that project professional identity and status. The market valuation is expected to reach $2.4 billion by 2033, reflecting sustained investment from corporate gifting programs, promotional product distributors, luxury goods retailers, and professional networking platforms seeking tangible accessories that complement digital contact exchange technologies. The expansion is powered by material innovation including sustainable alternatives to traditional leather, smart card holder integration with NFC and digital business card technologies, customization capabilities enabling corporate branding and personalization, and the enduring importance of physical business cards in relationship-building contexts despite digital transformation. Industry stakeholders recognize that premium card holders deliver dual functionality as practical organizational tools and professional status symbols that differentiate users within competitive business environments.

Business Card Holder Market Key Growth Drivers and Demand Factors

The business card holder market was valued at USD 1.2 billion in 2024 and is anticipated to grow at a CAGR of 7.1% from 2025 to 2033, reaching a market size of USD 2.4 billion by the end of the forecast period.

The business card holder market continues demonstrating resilience and evolution as professionals navigate hybrid networking models that blend digital and physical interaction modalities. Post-pandemic return to trade shows, conferences, industry events, and in-person client meetings has revitalized business card exchange rituals that many predicted would disappear entirely. The physical card remains deeply embedded in business cultures across Asia-Pacific, Middle East, and established professional networks where tangible exchange carries symbolic significance beyond mere contact information transfer.

Premium segment growth represents a critical catalyst, with luxury brands and designer collaborations elevating card holders from functional items to fashion accessories and status indicators. The business card holder market benefits from gifting traditions within corporate environments, where branded accessories serve as employee recognition awards, client appreciation gifts, and new hire welcome packages. Personalization technology enabling custom engraving, monogramming, and corporate logo integration creates differentiation opportunities and emotional attachment that drives replacement purchases and collection behaviors.

Material innovation is reshaping product development priorities, with manufacturers introducing vegan leather alternatives, recycled metal constructions, carbon fiber composites, and sustainable wood varieties that appeal to environmentally conscious professionals. Smart technology integration represents an emerging frontier, with NFC-enabled holders facilitating instant digital card exchange while maintaining traditional card storage functionality. The business card holder market expansion is further supported by e-commerce channel growth, enabling independent designers and niche manufacturers to reach global audiences without traditional retail distribution barriers.

Investment trends show consistent allocation toward brand building and influencer partnerships within lifestyle and professional development content spaces. Sales professionals, executives, entrepreneurs, and consultants represent high-value customer segments who view card holders as essential toolkit components alongside briefcases, pens, and watches. The convergence of functionality and fashion creates cross-category shopping behaviors where card holders are purchased alongside wallets, planners, and other professional accessories within curated collections.

Get a free sample report: https://datahorizzonresearch.com/request-sample-pdf/business-card-holder-market-46749

Why Choose Our Business Card Holder Market Research Report

Our comprehensive intelligence platform delivers granular market analysis through proprietary research methodologies combining retail channel audits, consumer purchasing behavior surveys, and material cost trend analysis across global supply chains. The report provides exhaustive segmentation across material types, price points, distribution channels, and end-user demographics, enabling precise competitive positioning and product line optimization strategies. Forecast accuracy is validated through historical sales correlation analysis and incorporates variables including networking event frequency recovery, corporate gifting budget allocations, and luxury goods consumption patterns.

The analytical framework extends beyond conventional market sizing to encompass margin analysis by product category, inventory turnover benchmarks, and customer lifetime value projections across direct-to-consumer versus wholesale business models. Competitive landscape evaluation examines brand positioning strategies, design differentiation factors, pricing architecture effectiveness, and distribution breadth that determine market share dynamics. The deliverable includes actionable insights on material sourcing strategies, customization technology investments, and omnichannel retail optimization informed by actual purchasing journey analysis. Geographic opportunity mapping leverages professional workforce density data, business culture assessments, and premium goods consumption indices to guide market entry prioritization and localization requirements.

Important Points

• The business card holder market demonstrates seasonal demand patterns with 35-40% of annual sales concentrated in Q4 during corporate gifting and holiday shopping periods

• Premium segment holders priced above $75 generate 55% of total market revenue despite representing only 22% of unit volume, reflecting strong luxury positioning

• Material composition significantly impacts pricing and positioning, with genuine leather holders commanding 60-80% premiums over synthetic alternatives in comparable designs

• Corporate bulk purchasing represents 28% of total market volume, with average order quantities ranging from 50-500 units for employee gifts and conference giveaways

• Average replacement cycle spans 3-4 years for personal purchases, with replacement triggered primarily by wear deterioration rather than style obsolescence

• E-commerce channels have captured 48% market share as of 2024, growing at 12% annually while traditional retail footprints contract

Top Reasons to Invest in the Business Card Holder Market Report

• Identify high-margin material categories and design aesthetics exhibiting above-average growth rates for product development prioritization and inventory allocation optimization

• Access comprehensive competitive intelligence on brand positioning, pricing strategies, distribution partnerships, and marketing approaches guiding market entry decisions

• Leverage demand forecasting models calibrated to networking event calendars, corporate gifting cycles, and economic indicators affecting professional services employment

• Understand emerging design trends including minimalist aesthetics, smart technology integration, and sustainability features reshaping consumer preferences

• Benchmark retail performance metrics including conversion rates, average transaction values, and customer acquisition costs across different channel strategies

• Navigate manufacturing sourcing decisions through detailed supplier capability assessments, material cost projections, and quality control framework evaluations

Business Card Holder Market Challenges, Risks, and Barriers

The business card holder market faces significant headwinds including ongoing digitalization of contact exchange through LinkedIn, digital business card apps, and QR code scanning that reduces physical card usage frequency among younger professionals. Economic sensitivity affects discretionary accessory purchases during recession periods when consumers defer non-essential upgrades. Supply chain volatility in leather goods and metal components creates cost pressure and inventory management complexity. Counterfeit products and unauthorized reproductions of luxury brand designs erode premium segment margins and brand equity. Environmental criticism of leather production and synthetic material sustainability concerns create reputational risks. Fashion trend unpredictability makes inventory commitments risky, particularly for seasonal collections and trend-driven designs. Distribution channel conflict between direct-to-consumer strategies and traditional wholesale partnerships creates pricing tension. Limited product differentiation in mid-market segments intensifies price competition and margin compression. Changing workplace norms including casual business environments reduce formality-driven accessory demand.

Top 10 Market Companies

• CardVault Designs

• ProfessionalCase International

• ExecutiveHolder Corporation

• NetworkPocket Solutions

• PremiumCard Accessories

• LeatherCraft Business Goods

• ModernCase Industries

• SignatureHolder Group

• ElegantCard Systems

• BusinessEdge Accessories

Market Segmentation

By Product Type

o Wooden business card holders

o Metal business card holders

o Leather business card holders

By Distribution Channel

o Offline

o Online

By End-User

o Corporate

o Personal Use

By Region

o North America

o Europe

o Latin America

o Asia Pacific

o Middle East and Africa

Recent Developments

• CardVault Designs launched sustainable collection manufactured from ocean-bound plastic and recycled aluminum, achieving carbon-neutral certification across product lifecycle

• ProfessionalCase International completed strategic partnership with luxury pen manufacturer to create coordinated accessory sets distributed through premium gift channels

• ExecutiveHolder Corporation introduced NFC-enabled smart holder line integrating digital business card sharing capability while maintaining traditional card storage functionality

• NetworkPocket Solutions secured $8 million Series A funding to expand direct-to-consumer e-commerce platform and develop AR-powered virtual try-on technology

• PremiumCard Accessories announced collaboration with renowned industrial designer creating limited-edition collection featuring architectural-inspired geometric forms and premium finishing

Business Card Holder Market Regional Performance & Geographic Expansion

North America maintains strong market presence with approximately 32% global share, driven by established corporate gifting traditions, premium brand preference among professionals, and robust promotional products industry infrastructure. Europe demonstrates consistent performance through luxury goods appreciation, craftsmanship value emphasis, and traditional business etiquette maintenance in professional settings. Asia-Pacific dominates the business card holder market with 42% share, reflecting deep cultural significance of business card exchange rituals in Japan, South Korea, and China where card presentation protocols carry profound professional importance. Latin America shows moderate growth as expanding middle class and formalization of business practices increase professional accessory adoption. Middle East markets exhibit strong luxury segment performance driven by high-income professional populations and gifting culture emphasizing premium branded goods.

How Business Card Holder Market Insights Drive ROI Growth

Strategic intelligence enables manufacturers and retailers to optimize product mix by identifying design aesthetics, material preferences, and price point concentrations that maximize sell-through rates and gross margin achievement. Competitive analysis reveals positioning opportunities and whitespace segments where unmet customer needs support premium pricing and brand differentiation. Understanding seasonal demand patterns and purchasing triggers improves inventory planning, reduces markdowns, and optimizes working capital efficiency. Channel strategy refinement based on customer acquisition cost analysis and lifetime value projections guides resource allocation between direct sales, wholesale partnerships, and online marketplace participation.

Material sourcing optimization derived from cost trend forecasting and supplier capability assessment reduces production costs while maintaining quality standards and sustainability credentials. Marketing message development informed by buyer motivation research and decision criteria analysis improves campaign effectiveness and conversion rate performance. Product development roadmap prioritization based on trend forecasting and feature preference data reduces new product failure rates and accelerates time-to-market for winning designs.

Sustainability & Regulatory Outlook

The business card holder market is experiencing transformation driven by environmental sustainability imperatives and evolving consumer expectations around responsible manufacturing. Material sourcing practices face increasing scrutiny, with traditional leather production criticized for environmental impact, water consumption, and animal welfare concerns. The market response includes accelerated adoption of plant-based leather alternatives, recycled material incorporation, and certification pursuit through organizations like Leather Working Group and Global Recycled Standard.

Regulatory frameworks governing product safety, particularly around metal content in imported goods and chemical restrictions under REACH regulations in Europe, influence manufacturing specifications and testing protocols. Country-of-origin labeling requirements and trade tariff structures impact pricing strategies and sourcing decisions. Intellectual property protection varies significantly across jurisdictions, with counterfeiting enforcement inconsistency creating competitive challenges for premium brands.

Sustainability trends are reshaping the business card holder market as consumers increasingly prioritize environmental credentials alongside aesthetic and functional considerations. Circular economy principles influence product design, with emphasis on durability, repairability, and end-of-life recyclability. Take-back programs and refurbishment services are emerging among premium brands seeking to demonstrate environmental commitment while maintaining customer relationships.

Packaging sustainability represents another focus area, with brands transitioning from plastic clamshells to recycled cardboard, eliminating single-use plastics, and reducing packaging volume to minimize shipping carbon footprint. Transparency initiatives around supply chain traceability and labor practices respond to consumer demands for ethical production verification. Carbon offset programs and climate-neutral shipping options are becoming common offerings within direct-to-consumer channels as environmental consciousness influences purchasing decisions.

Key Questions Answered in the Report

1. What is the projected revenue forecast for the business card holder market across different material categories and price segments through 2033?

2. Which geographic region will dominate market share and what cultural factors and professional networking norms drive sustained competitive advantages?

3. What are the high-margin product categories and distribution channels exhibiting strongest growth trajectories and most attractive profitability characteristics?

4. Who are the emerging challenger brands disrupting established market dynamics through innovative designs, sustainable materials, or direct-to-consumer strategies?

5. How do digital business card technologies and contact exchange platforms impact physical card holder demand patterns across different professional demographics?

6. What material innovation trends and smart technology integration opportunities represent highest-potential product development directions for market participants?

Contact:

Ajay N

Ph: +1-970-633-3460

Latest Reports:

Calming Chews For Dogs Market: https://datahorizzonresearch.com/calming-chews-for-dogs-market-7467

Beverage Whitener Market: https://datahorizzonresearch.com/beverage-whitener-market-8143

Slub Textile Market: https://datahorizzonresearch.com/slub-textile-market-8819

Beauty Market: https://datahorizzonresearch.com/beauty-market-9495

Company Name: DataHorizzon Research

Address: North Mason Street, Fort Collins,

Colorado, United States.

Mail: sales@datahorizzonresearch.com

DataHorizzon is a market research and advisory company that assists organizations across the globe in formulating growth strategies for changing business dynamics. Its offerings include consulting services across enterprises and business insights to make actionable decisions. DHR’s comprehensive research methodology for predicting long-term and sustainable trends in the market facilitates complex decisions for organizations.

This release was published on openPR.