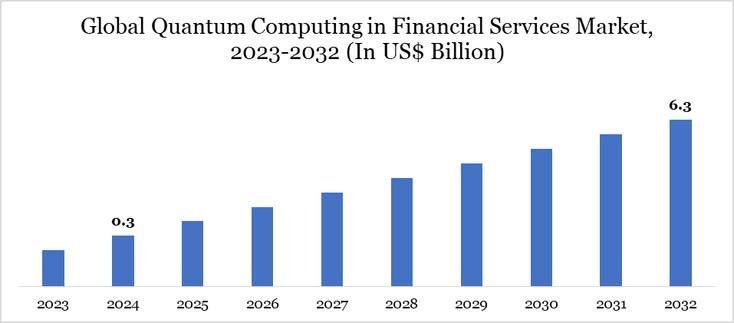

The Quantum Computing in Financial Services Market reached a value of US$ 0.3 billion in 2024 and is projected to reach US$ 6.3 billion by 2032, growing at an impressive CAGR of 46.5% during the forecast period 2025-2032.

Growth is driven by the increasing need for high-speed data processing, advanced risk modeling, portfolio optimization, and fraud detection across the financial sector. Financial institutions are increasingly investing in quantum algorithms, hybrid quantum classical computing, and cloud based quantum platforms to gain competitive advantages in complex problem solving. Additionally, rising collaborations between banks, fintech firms, and quantum technology providers, along with advancements in quantum hardware, software, and error correction, are accelerating market adoption. The growing focus on cybersecurity, real-time decision making, and next-generation financial analytics is further fueling the expansion of quantum computing in financial services globally.

Download Your Sample Report Instantly – Corporate Email ID Required for Priority Access:

https://www.datamintelligence.com/download-sample/quantum-computing-in-financial-services-market?praneetha

☛ Quantum Computing in Financial Services: Competitive Intelligence

The major global players in the market include IBM Corporation, Intel Corporation, IonQ Inc., Silicon Quantum Computing, Huawei Technologies Co., Ltd., Alphabet Inc., Rigetti & Co., LLC, Microsoft Corporation, D-Wave Quantum Inc., and Zapata Computing Inc., among others.

The Quantum Computing in Financial Services market is being rapidly advanced by leading technology players such as IBM, Microsoft, Alphabet (Google), Intel, and D-Wave Quantum, which are developing scalable quantum hardware, cloud-based quantum platforms, and hybrid quantum classical algorithms tailored for financial use cases. Their solutions enable enhanced portfolio optimization, risk modeling, fraud detection, derivative pricing, and high frequency trading, delivering significant computational advantages over classical systems.

These companies’ complementary strengths including IBM and Microsoft’s enterprise grade cloud ecosystems, Google and Intel’s hardware innovation, D-Wave’s annealing based optimization capabilities, and IonQ and Rigetti’s specialized quantum architectures are accelerating adoption across banks, asset managers, and insurance providers. Continuous investments in quantum algorithms, error correction, and financial specific applications, along with strategic partnerships with financial institutions, are strengthening competitiveness and driving the transition from pilot programs to real-world deployment in capital markets and risk analytics.

Get Customization in the Report as per Your Requirements:

https://www.datamintelligence.com/customize/quantum-computing-in-financial-services-market?praneetha

☛ New Product Launches

IBM

IBM expanded its IBM Quantum System Two access for financial institutions, enabling banks and asset managers to run advanced risk modeling and portfolio optimization workloads on utility-scale quantum systems. The platform integrates quantum hardware with classical HPC and secure cloud access for enterprise users.

Google Quantum AI

Google Quantum AI announced enhanced quantum simulation and optimization tools for financial use cases, focusing on Monte Carlo simulations and complex optimization problems relevant to derivatives pricing. These tools are delivered via Google Cloud’s secure research partnerships with financial institutions.

☛ R&D Developments

JPMorgan Chase

JPMorgan Chase continued R&D collaboration with quantum technology providers to explore quantum algorithms for option pricing, fraud detection, and portfolio optimization. The bank emphasized hybrid quantum classical approaches as a near term path to commercial value.

Goldman Sachs

Goldman Sachs advanced internal research on quantum-enhanced Monte Carlo methods to improve speed and accuracy in risk calculations. The firm highlighted quantum readiness as part of its long-term technology investment strategy for capital markets.

☛ Technological Advancements

Hybrid Quantum Classical Computing

The financial services sector is increasingly adopting hybrid quantum classical architectures, combining quantum processors with classical HPC to solve complex optimization and simulation problems. This approach enables practical experimentation while mitigating current quantum hardware limitations.

Quantum Algorithms for Risk & Optimization

Advancements in quantum algorithms, including quantum amplitude estimation and optimization solvers, are improving the theoretical performance of risk modeling and portfolio optimization. These developments are particularly relevant for large scale financial datasets.

☛ M&A / Strategic Developments

IBM – Strategic Partnerships & Acquisitions

IBM continued expanding its quantum ecosystem through strategic partnerships and targeted acquisitions, strengthening software capabilities and industry specific solutions for financial services. These moves support IBM’s goal of accelerating enterprise quantum adoption.

☛ Segment Covered in the Quantum Computing in Financial Services Market :

By Offering

The market is segmented into Software 45%, Services 35%, and Hardware 20%, with software dominating due to rising demand for quantum algorithms, simulation platforms, and optimization tools tailored for financial modeling and risk analysis. Services are growing rapidly as financial institutions rely on consulting, integration, and managed services to implement quantum solutions. Hardware adoption remains limited but is gradually increasing with advancements in quantum processors and increased R&D investments.

By Deployment Type

Deployment types include Cloud-based 70% and On-premises 30%, with cloud-based deployment dominating due to ease of access, scalability, and lower upfront infrastructure costs. Cloud platforms enable financial institutions to experiment with quantum computing without heavy capital investment. On-premises deployment is preferred by large banks and institutions with stringent data security and regulatory requirements, particularly for sensitive financial operations.

By Technology

The market is segmented into Quantum Annealing 40%, Trapped Ions 35%, and Quantum Dots 25%, with quantum annealing leading due to its commercial availability and suitability for optimization problems such as portfolio optimization and fraud detection. Trapped ions are gaining traction owing to high accuracy and stability, making them suitable for complex financial simulations. Quantum dots remain in early stage adoption but show strong potential for scalable quantum systems.

By Application

Applications include Risk & Cybersecurity 30%, Investment Banking 20%, Asset & Wealth Management 15%, Corporate Banking 10%, Retail Banking 10%, Payments 10%, and Others 5%, with risk & cybersecurity dominating due to the need for advanced threat detection, encryption, and fraud prevention. Investment banking leverages quantum computing for pricing models and trading strategies. Asset & wealth management uses quantum algorithms for portfolio optimization, while payments and retail banking focus on transaction security and efficiency.

☛ Regional Analysis

North America – 40% Share

North America leads with 40% share driven by strong presence of quantum technology providers, early adoption by major financial institutions, and significant investments in R&D. The U.S. dominates the region with extensive use of cloud-based quantum platforms. Risk management, cybersecurity, and investment banking applications are the primary growth drivers.

Europe – 25% Share

Europe accounts for 25% share supported by strong government-backed quantum initiatives and adoption across the UK, Germany, and France. Financial institutions focus on risk analytics, regulatory compliance, and asset management applications. Cloud-based deployments and trapped ion technologies are gaining traction across the region.

Asia-Pacific – 20% Share

Asia-Pacific holds 20% share driven by rapid digital transformation in financial services and increasing investments in quantum research in China, Japan, South Korea, and India. Banks and fintech firms are exploring quantum solutions for fraud detection, payments optimization, and portfolio management. Government-led innovation programs support market expansion.

Buy Now & Unlock 360° Market Intelligence:

https://www.datamintelligence.com/buy-now-page?report=quantum-computing-in-financial-services-market?praneetha

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?praneetha

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Company Name: DataM Intelligence 4Market Research LLP

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com/

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.